flyExclusive, Inc. Q3 2025 Earnings Review November 12, 2025

FORWARD-LOOKING INFORMATION. This Presentation contains certain forward-looking statements within the meaning of the U.S. federal securities laws with respect to flyExclusive the products and services offered by flyExclusive and the markets in which it operates and flyExclusive’s expectations, intentions, strategies, assumptions or beliefs about future events, results of operations or performance or that do not solely relate to historical or current facts. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “scales,” “representative of,” “valuation,” “potential,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Presentation, including but not limited to: (i) the occurrence of any event, change or other circumstance that could give rise to a change in flyExclusive’s business or results of operations, (ii) the ability to maintain the listing of flyExclusive’s securities on a national securities exchange, (iii) changes in the capital structure of flyExclusive, (iv) changes in the competitive industries and markets in which flyExclusive operates or plans to operate, (v) changes in laws and regulations affecting flyExclusive’s business, (vi) the ability to implement business plans, forecasts, and other expectations, and identify and realize additional opportunities, (vii) risks related to flyExclusive’s potential inability to achieve or maintain profitability and generate cash, (viii) current and future conditions in the global economy and their impact on flyExclusive, its business and markets in which it operates, (ix) the potential inability of flyExclusive to manage growth effectively, (x) flyExclusive’s customer concentration, and (xi) the ability to recruit, train and retain qualified personnel. The foregoing list of risk factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in flyExclusive’s Form 10-K filed on March 24, 2025 and other documents filed or to be filed with the U.S. Securities and Exchange Commission (the “SEC”). Disclaimers & Other Important Information

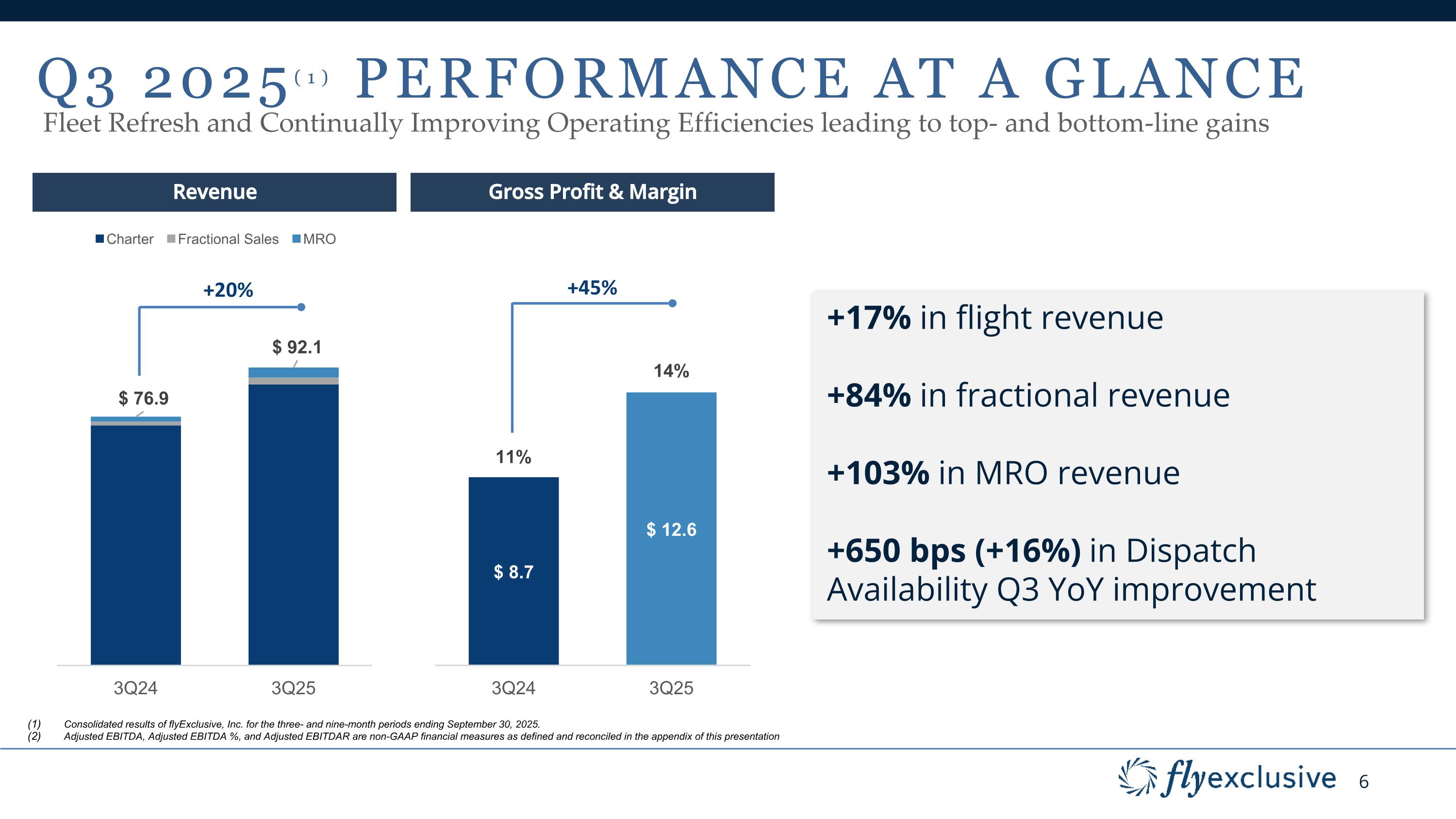

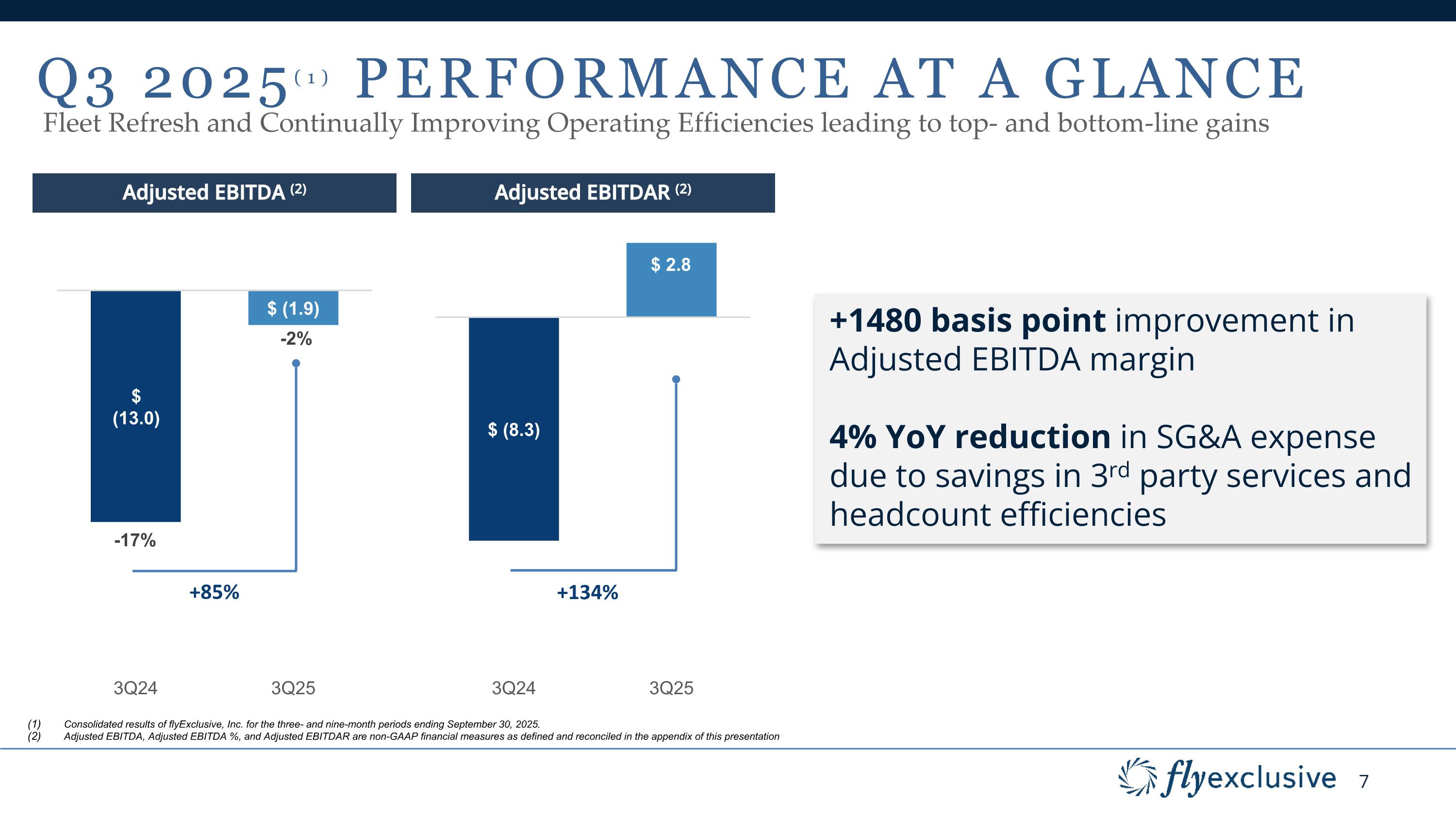

I. EXECUTIVE SUMMARY Q3 2025 HIGHLIGHTS Strong Growth & Broad Execution $92 million in consolidated revenue +20% YoY revenue growth Double digit growth across each Jet Club, MRO, & Fractional categories +84% growth in fractional sales Robust Efficiency Gains Continued execution on eliminating non- performing A/C +15% growth in flight hours with 20% fewer aircraft Improved Profitability +45% YoY increase in gross profit 1,480 bps improvement in Adj. EBITDA

Who We are Minutes Matter Humble Professionals Winning Attitude Safety First Larger Cause Trusted partner in private jet travel, providing our clients with curated jet experiences that anticipate their needs for comfort and style World-class private aviation company providing a reliable travel experience and exclusive customer benefits Product suite serves range of client needs while diversifying revenue streams, with ~50% of revenue contracted on an annual basis Industry-leading fleet with 90+ light to heavy jets on certificate and 100% operational control Fastest growing operator since 2019 and the 5th largest private operator in the U.S. Fleet modernization and 24/7 maintenance, avionics, and interior refurbishment to maintain highest quality fleet

I. EXECUTIVE SUMMARY Q3 2025 PERFORMANCE

Q3 2025(1) Performance at a glance Fleet Refresh and Continually Improving Operating Efficiencies leading to top- and bottom-line gains Revenue Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Adjusted EBITDA, Adjusted EBITDA %, and Adjusted EBITDAR are non-GAAP financial measures as defined and reconciled in the appendix of this presentation +20% Gross Profit & Margin +45% +17% in flight revenue +84% in fractional revenue +103% in MRO revenue +650 bps (+16%) in Dispatch Availability Q3 YoY improvement

Q3 2025(1) Performance at a glance Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Adjusted EBITDA, Adjusted EBITDA %, and Adjusted EBITDAR are non-GAAP financial measures as defined and reconciled in the appendix of this presentation Adjusted EBITDA (2) Adjusted EBITDAR (2) +1480 basis point improvement in Adjusted EBITDA margin 4% YoY reduction in SG&A expense due to savings in 3rd party services and headcount efficiencies +85% +134% Fleet Refresh and Continually Improving Operating Efficiencies leading to top- and bottom-line gains

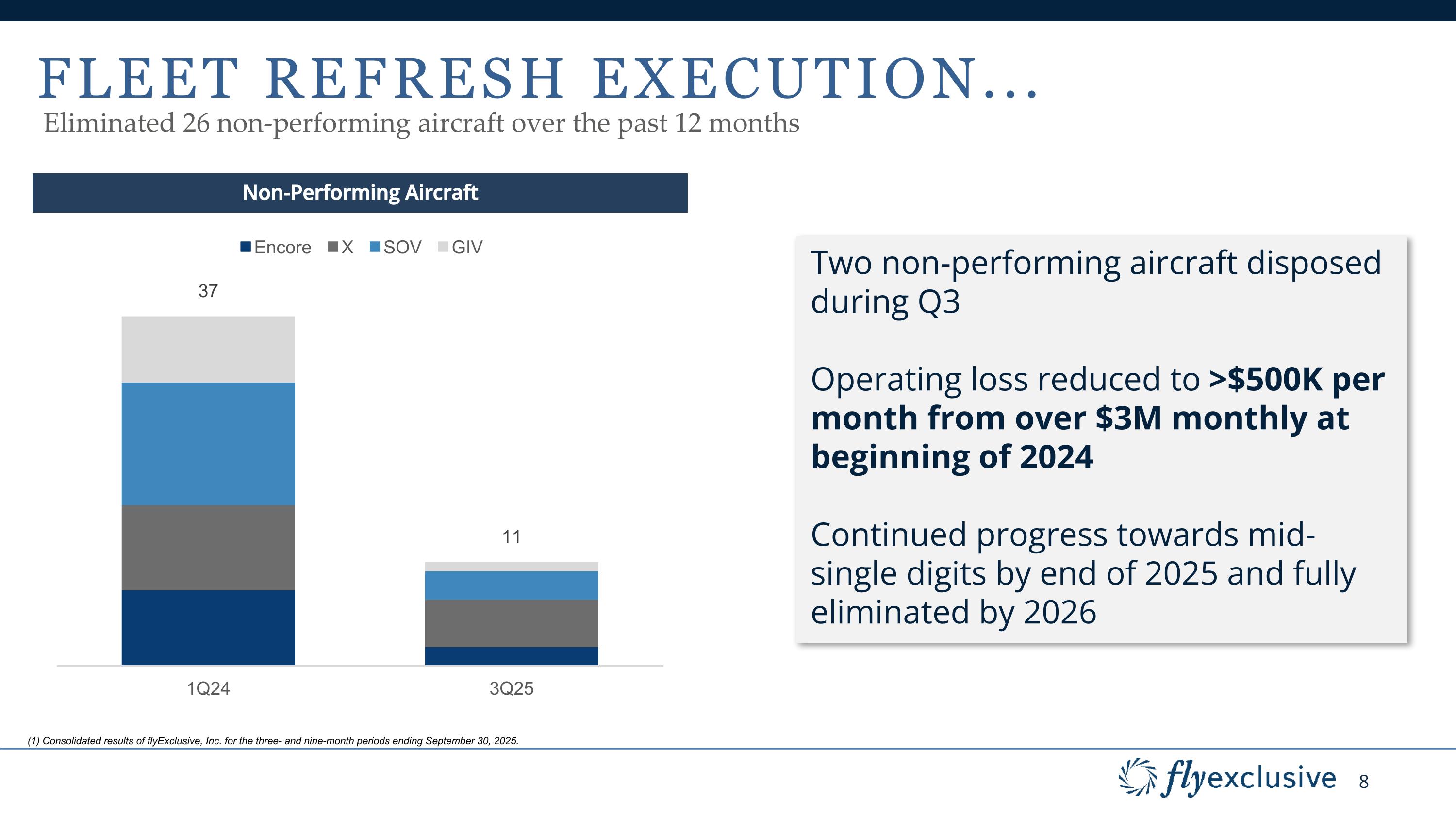

Fleet refresh execution... Eliminated 26 non-performing aircraft over the past 12 months Non-Performing Aircraft (1) Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Two non-performing aircraft disposed during Q3 Operating loss reduced to >$500K per month from over $3M monthly at beginning of 2024 Continued progress towards mid-single digits by end of 2025 and fully eliminated by 2026

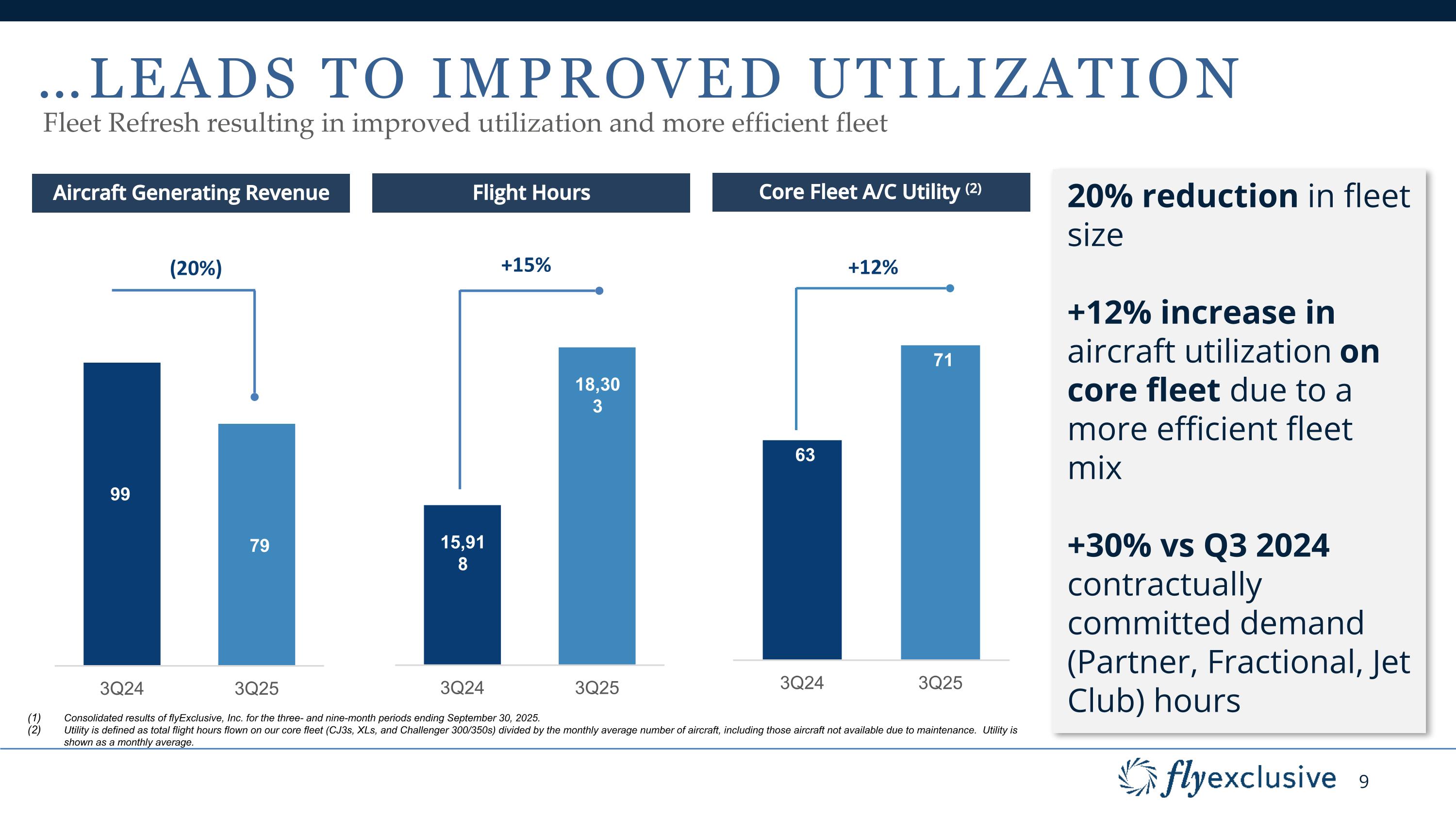

…Leads to Improved utilization Fleet Refresh resulting in improved utilization and more efficient fleet Aircraft Generating Revenue Flight Hours 20% reduction in fleet size +12% increase in aircraft utilization on core fleet due to a more efficient fleet mix +30% vs Q3 2024 contractually committed demand (Partner, Fractional, Jet Club) hours Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Utility is defined as total flight hours flown on our core fleet (CJ3s, XLs, and Challenger 300/350s) divided by the monthly average number of aircraft, including those aircraft not available due to maintenance. Utility is shown as a monthly average. (20%) +15% Core Fleet A/C Utility +12% Core Fleet A/C Utility (2)

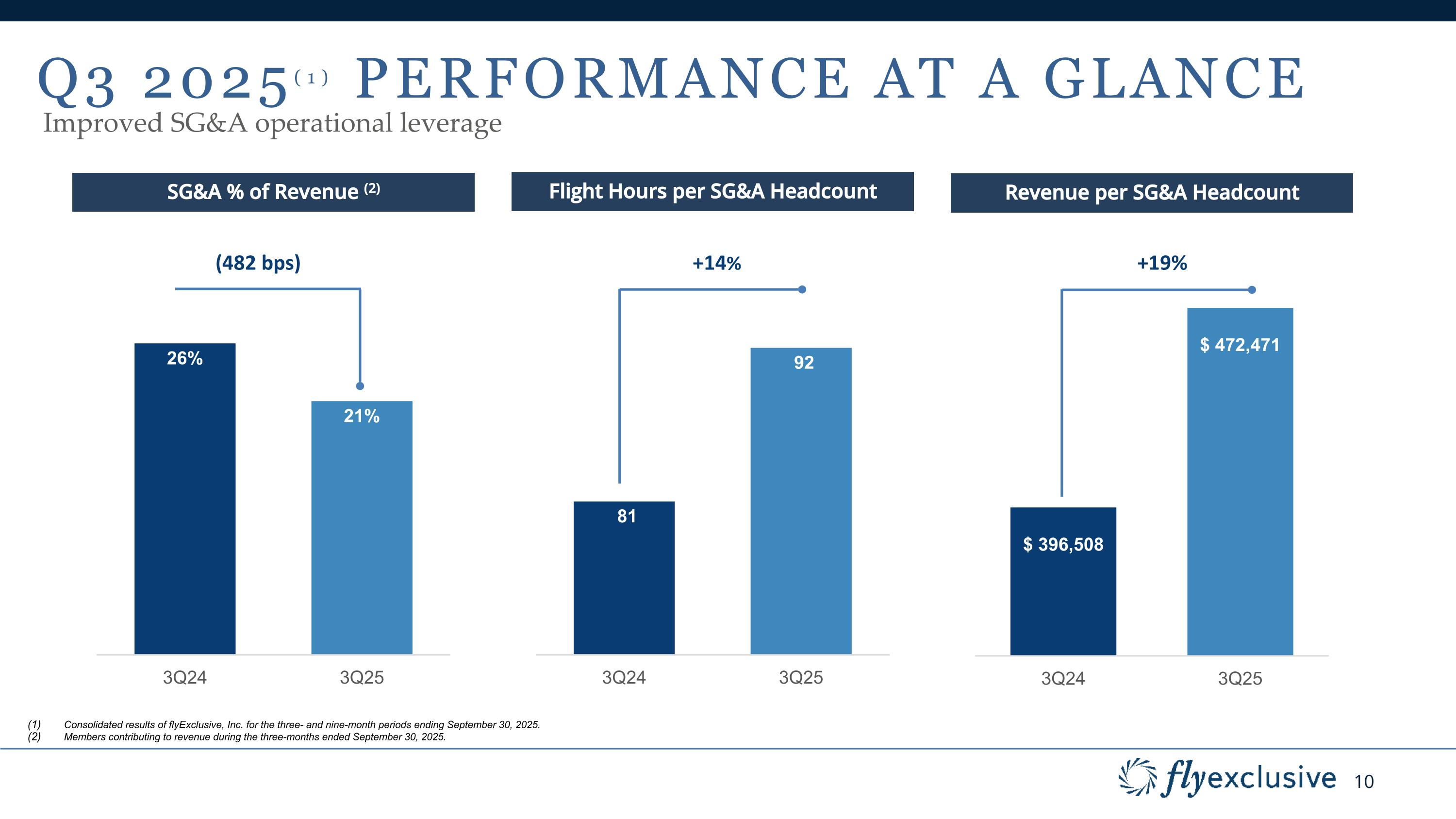

Q3 2025(1) Performance at a glance Improved SG&A operational leverage SG&A % of Revenue (2) Flight Hours per SG&A Headcount Revenue per SG&A Headcount Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Members contributing to revenue during the three-months ended September 30, 2025. (482 bps) +14% +19%

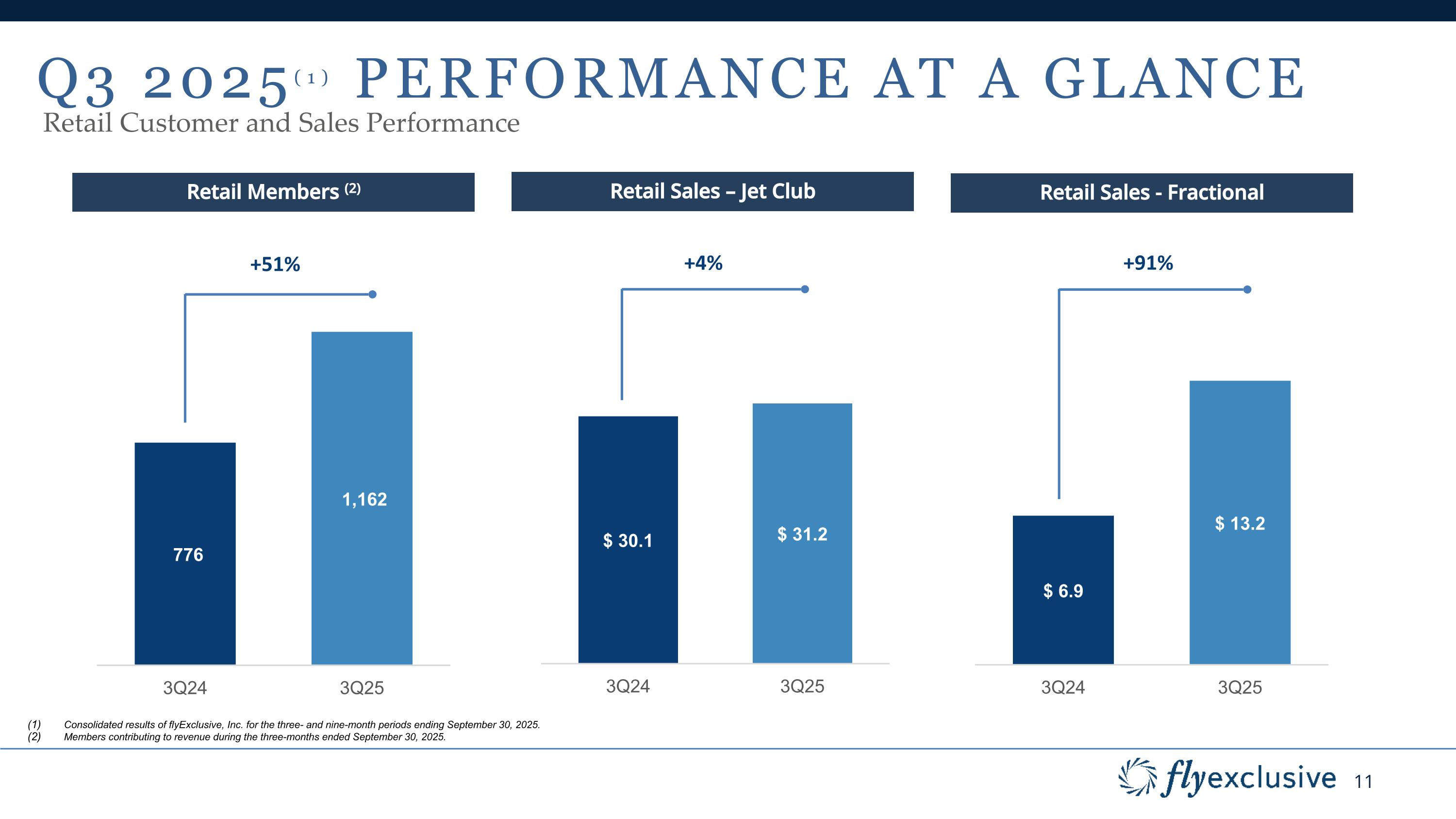

Q3 2025(1) Performance at a glance Retail Customer and Sales Performance Retail Members (2) Retail Sales – Jet Club Retail Sales - Fractional +51% +4% +91% Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Members contributing to revenue during the three-months ended September 30, 2025.

I. EXECUTIVE SUMMARY YTD 2025 PERFORMANCE

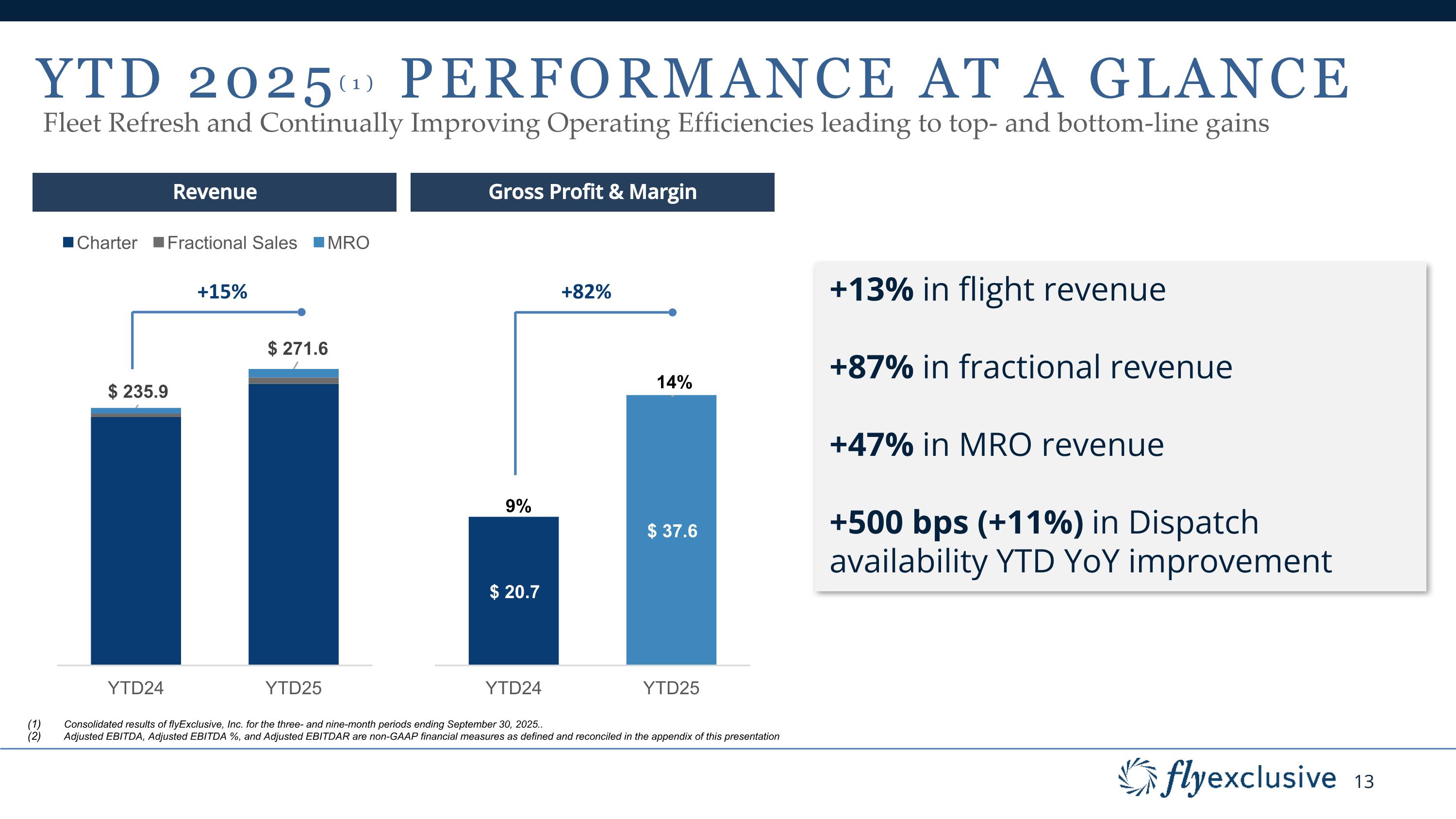

YTD 2025(1) Performance at a glance Revenue Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025.. Adjusted EBITDA, Adjusted EBITDA %, and Adjusted EBITDAR are non-GAAP financial measures as defined and reconciled in the appendix of this presentation +15% Gross Profit & Margin +82% +13% in flight revenue +87% in fractional revenue +47% in MRO revenue +500 bps (+11%) in Dispatch availability YTD YoY improvement Fleet Refresh and Continually Improving Operating Efficiencies leading to top- and bottom-line gains

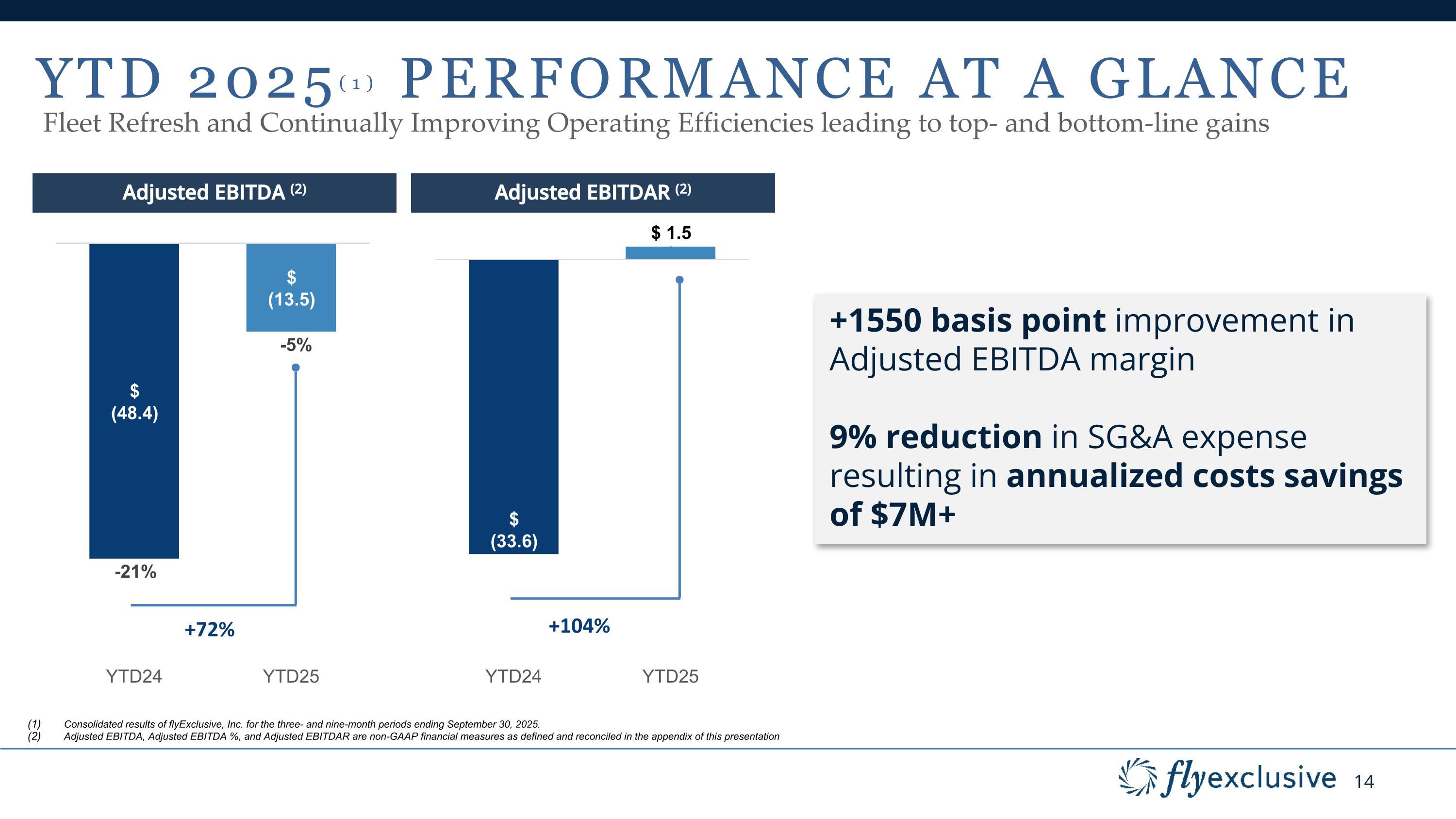

YTD 2025(1) Performance at a glance Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Adjusted EBITDA, Adjusted EBITDA %, and Adjusted EBITDAR are non-GAAP financial measures as defined and reconciled in the appendix of this presentation Adjusted EBITDA (2) Adjusted EBITDAR (2) +1550 basis point improvement in Adjusted EBITDA margin 9% reduction in SG&A expense resulting in annualized costs savings of $7M+ +72% +104% Fleet Refresh and Continually Improving Operating Efficiencies leading to top- and bottom-line gains

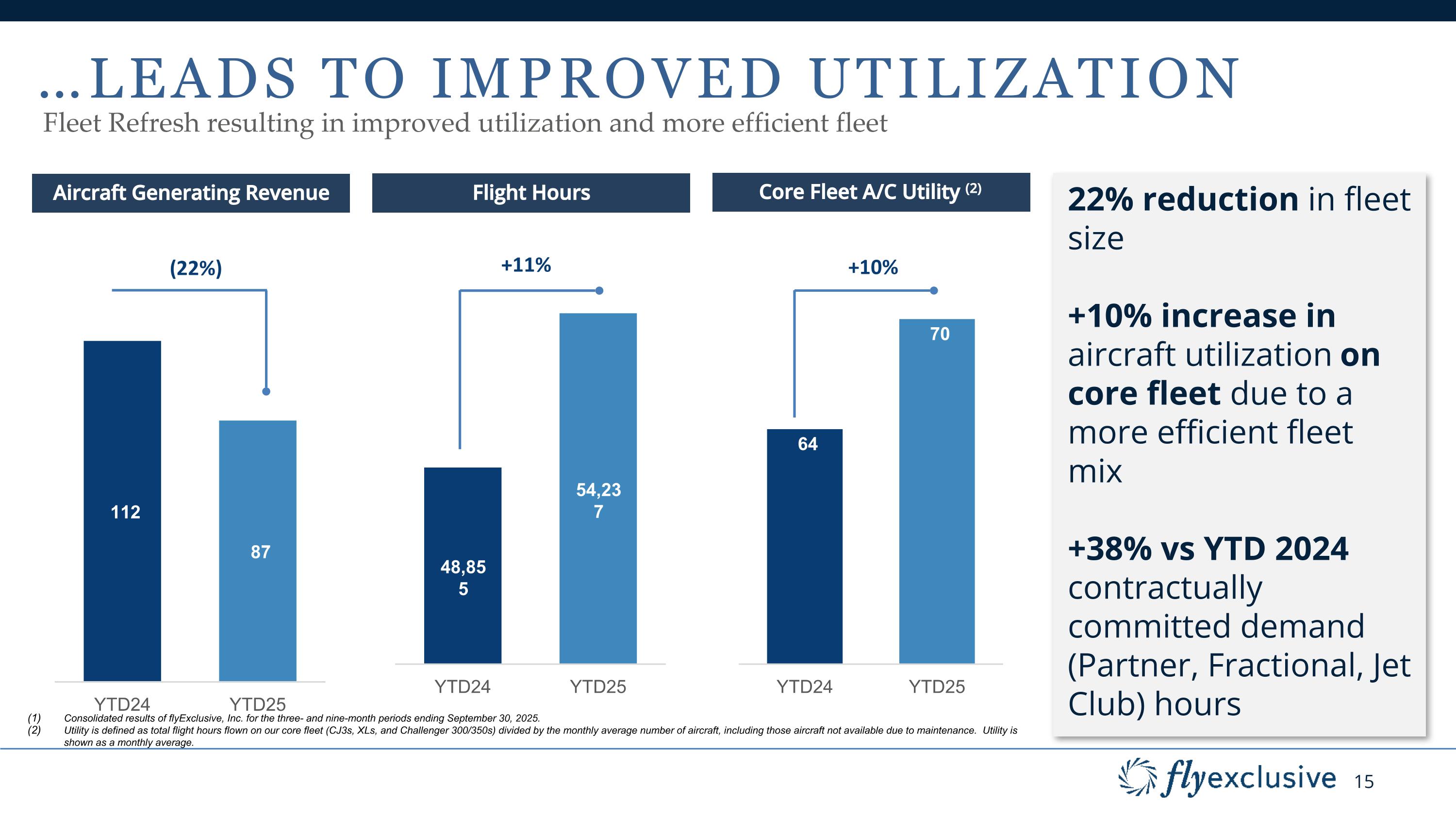

…Leads to Improved utilization Fleet Refresh resulting in improved utilization and more efficient fleet Aircraft Generating Revenue Flight Hours 22% reduction in fleet size +10% increase in aircraft utilization on core fleet due to a more efficient fleet mix +38% vs YTD 2024 contractually committed demand (Partner, Fractional, Jet Club) hours Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Utility is defined as total flight hours flown on our core fleet (CJ3s, XLs, and Challenger 300/350s) divided by the monthly average number of aircraft, including those aircraft not available due to maintenance. Utility is shown as a monthly average. (22%) +11% Core Fleet A/C Utility +10% Core Fleet A/C Utility (2)

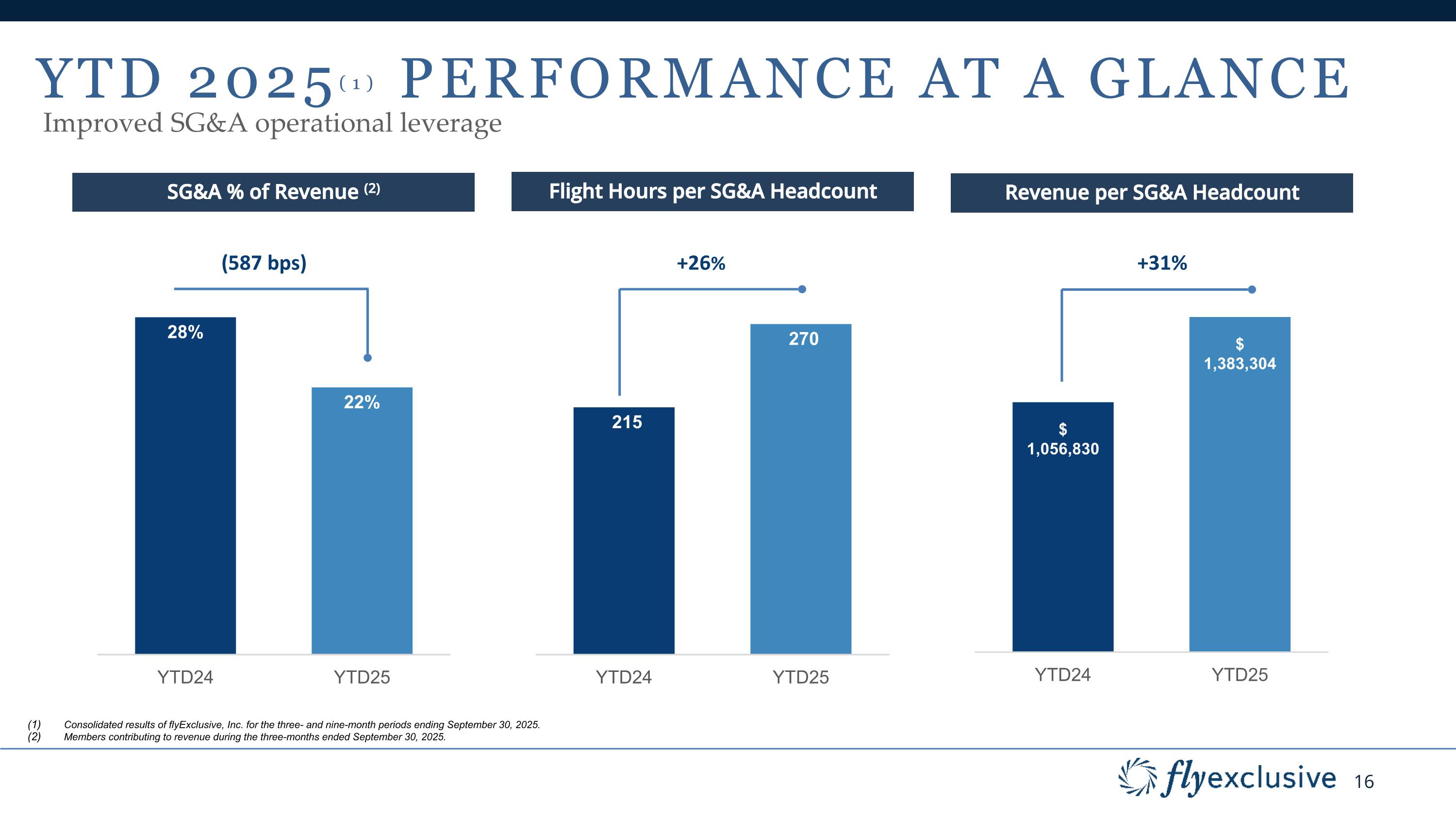

YTD 2025(1) Performance at a glance Improved SG&A operational leverage SG&A % of Revenue (2) Flight Hours per SG&A Headcount Revenue per SG&A Headcount Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Members contributing to revenue during the three-months ended September 30, 2025. (587 bps) +26% +31%

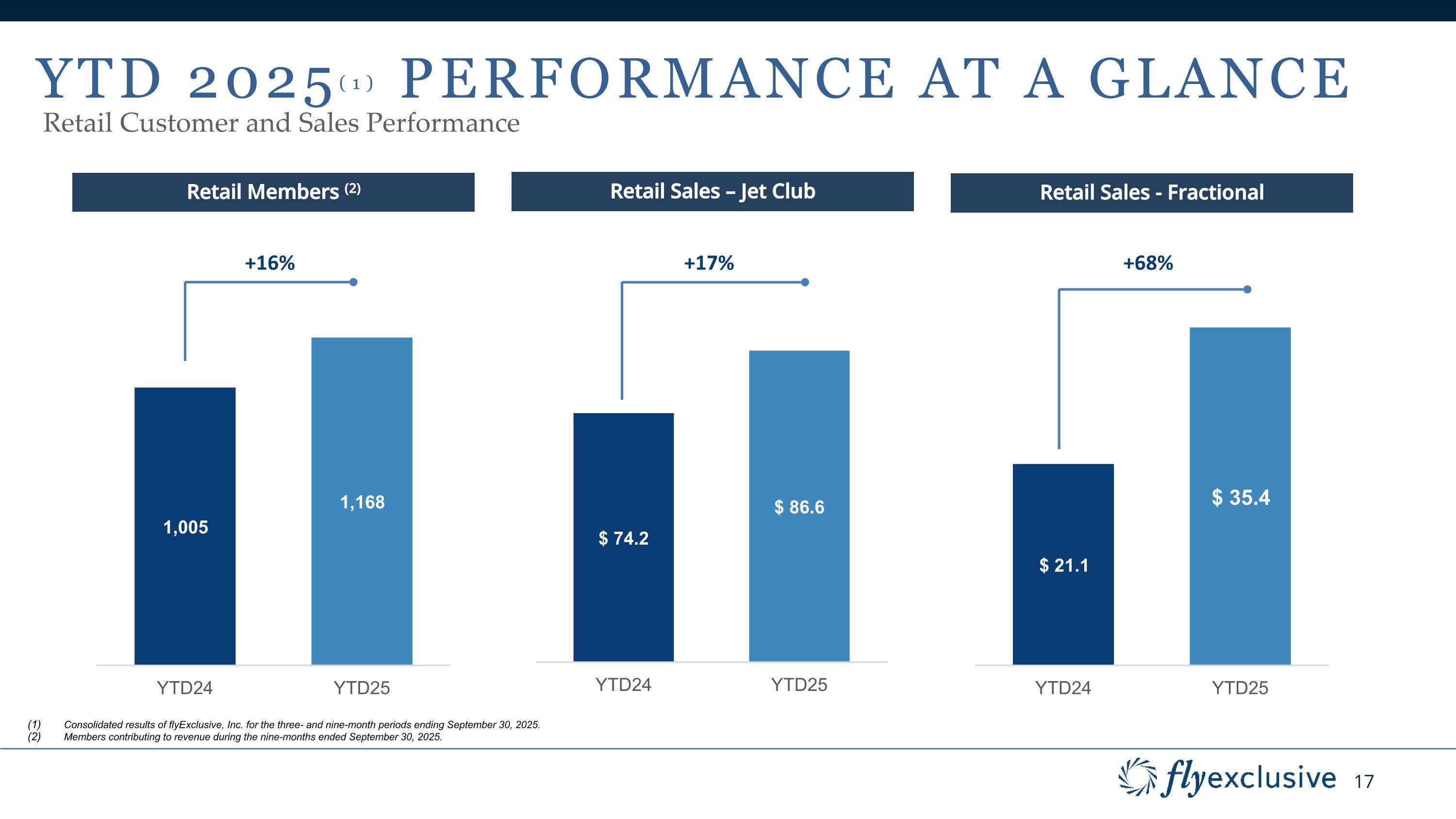

YTD 2025(1) Performance at a glance Retail Customer and Sales Performance Retail Sales – Jet Club Retail Sales - Fractional +16% +17% +68% Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. Members contributing to revenue during the nine-months ended September 30, 2025. Retail Members (2)

I. EXECUTIVE SUMMARY APPENDIX

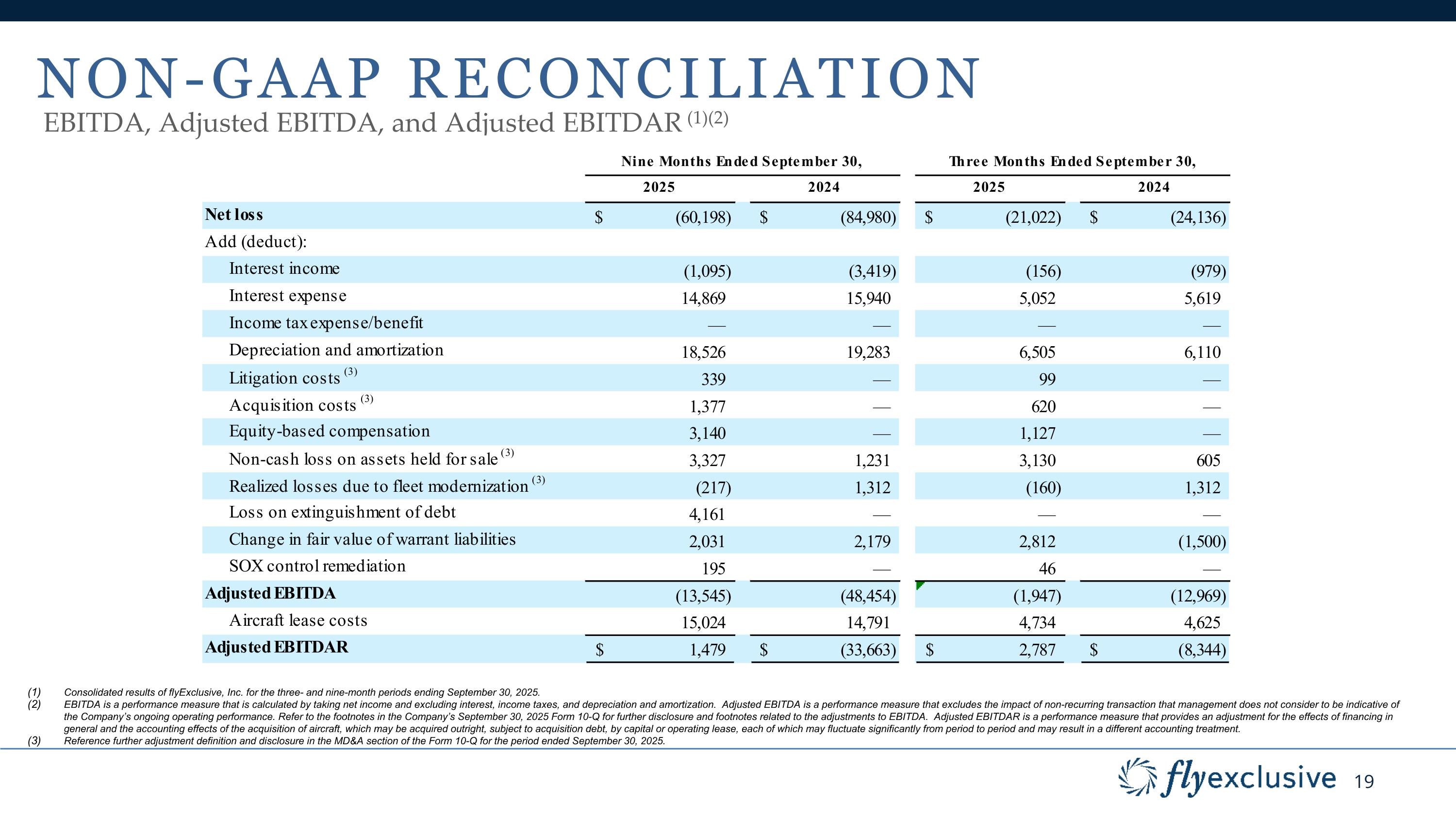

Non-Gaap Reconciliation EBITDA, Adjusted EBITDA, and Adjusted EBITDAR (1)(2) Consolidated results of flyExclusive, Inc. for the three- and nine-month periods ending September 30, 2025. EBITDA is a performance measure that is calculated by taking net income and excluding interest, income taxes, and depreciation and amortization. Adjusted EBITDA is a performance measure that excludes the impact of non-recurring transaction that management does not consider to be indicative of the Company’s ongoing operating performance. Refer to the footnotes in the Company’s September 30, 2025 Form 10-Q for further disclosure and footnotes related to the adjustments to EBITDA. Adjusted EBITDAR is a performance measure that provides an adjustment for the effects of financing in general and the accounting effects of the acquisition of aircraft, which may be acquired outright, subject to acquisition debt, by capital or operating lease, each of which may fluctuate significantly from period to period and may result in a different accounting treatment. Reference further adjustment definition and disclosure in the MD&A section of the Form 10-Q for the period ended September 30, 2025.