UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 20, 2023

EG ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40444 | 86-1740840 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

375 Park Avenue, 24th Floor

New York, NY 10152

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: 212-888-1040

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange on which registered | ||

| Units | EGGFU | The New York Stock Exchange | ||

| Class A shares | EGGF | The New York Stock Exchange | ||

| Warrants | EGGFW | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On November 20, 2023, EG Acquisition Corp. (the “Company”) held meetings with potential investors in connection with its previously announced proposed business combination (the “Business Combination”) with LGM Enterprises, LLC (“flyExclusive”). The investor presentation from the meetings is furnished as Exhibit 99.1 hereto, and incorporated into this Item 7.01 by reference.

The information furnished with this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Additional Information

The Company filed a proxy statement (the “Definitive Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) on November 13, 2023 in connection with the Business Combination pursuant to the equity purchase agreement, dated as of October 17, 2022, by and among the Company, flyExclusive and other parties (the “Equity Purchase Agreement”), and the Company mailed the definitive proxy statement and other relevant documents to its stockholders of record as of November 13, 2023. This communication does not contain all the information that should be considered concerning the Business Combination. It is not intended to provide the basis for any investment decision or any other decision in respect to the proposed Business Combination. The Company’s stockholders and other interested persons are advised to read the Definitive Proxy Statement, and any amendments thereto, in connection with the Company’s solicitation of proxies for the special meeting to be held to approve the Business Combination as these materials may contain important information about flyExclusive and the Company and the proposed Business Combination. The definitive proxy statement was mailed to the Company’s stockholders of record as of November 13, 2023. Such stockholders may also obtain copies of the definitive proxy statement, without charge, at the SEC’s website at http://www.sec.gov.

Participants in the Solicitation

The Company, its Sponsor, and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of the Company’s stockholders in connection with the Business Combination. Investors and security holders may obtain more detailed information regarding the names and interests in the Business Combination of the Company’s directors and officers in the Company’s filings with the SEC, including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on April 13, 2023, and the Definitive Proxy Statement. Stockholders can obtain copies of the Company’s filings with the SEC, without charge, at the SEC’s website at www.sec.gov.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of the Company’s securities, (ii) the risk that the transaction may not be completed by the Company’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by the Company, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the approval by the stockholders of the Company and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third-party valuation in determining whether or not to pursue the transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Equity Purchase Agreement, (vi) the effect of the announcement or pendency of the transaction on flyExclusive’s business relationships, operating results and business generally, (vii) risks that the proposed transaction disrupts current plans and operations of flyExclusive and potential difficulties in flyExclusive

- 2 -

employee retention as a result of the transaction, (viii) the outcome of any legal proceedings that may be instituted against flyExclusive or against the Company related to the Equity Purchase Agreement or the transaction, (ix) the ability to maintain the listing of the Company’s securities on a national securities exchange, (x) the price of the Company’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which the Company plans to operate or flyExclusive operates, variations in operating performance across competitors, changes in laws and regulations affecting the Company’s or flyExclusive’s business and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, and (xii) the risk of downturns and a changing regulatory landscape in the highly competitive aviation industry. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Company’s registration on Form S-1, the Definitive Proxy Statement and other documents filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and flyExclusive and the Company assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. flyExclusive nor the Company gives any assurance that either flyExclusive or the Company or the combined company will achieve its expectations.

The Company cautions that the foregoing list of factors is not exclusive. The Company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors section of the Company’s Annual Report on Form 10-K filed with the SEC. The Company’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, the Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description | |

| 99.1 | Investor Presentation dated November 20, 2023 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

- 3 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 20, 2023 | EG ACQUISITION CORP. | |||||

| By: | /s/ Gregg S. Hymowitz | |||||

| Name: | Gregg S. Hymowitz | |||||

| Title: | Chief Executive Officer | |||||

- 4 -

Exhibit 99.1 1

DI S CL A I M E RS AN D O T H E R IM P OR T A N T IN F OR M A T ION This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential acquisition by EG Acquisition Corp (“EGGF”) of LGM Enterprises, LLC and its affiliates, together doing business as “flyExclusive” (together “LGM Enterprises”) and related transactions (the “Potential Business Combination”) and a potential proposed private offering of public equity (the “PIPE Offering”), and for no other purpose. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the Potential Business Combination, the PIPE Offering or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. No representations or warranties, express or implied, are given in, or in respect of, this Presentation. This Presentation is subject to updating, completion, revision, verification and further amendment. None of EGGF, LGM Enterprises, BTIG, LLC (“BTIG”) or their respective affiliates has authorized anyone to provide interested parties with additional or different information. No securities regulatory authority has expressed an opinion about the securities discussed in this Presentation and it is an offense to claim otherwise. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with EGGF, LGM Enterprises, BTIG or their respective representatives, as investment, legal or tax advice. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of EGGF, LGM Enterprises, the Potential Business Combination or the PIPE Offering. Recipients of this Presentation should each make their own evaluation of EGGF, LGM Enterprises, the Potential Business Combination and the PIPE Offering and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. F O RW A RD - L OOK IN G IN F OR M A T ION This Presentation (and oral statements regarding the subjects of this Presentation) contains certain forward-looking statements within the meaning of the U.S. federal securities laws with respect to LGM Enterprises and the Potential Business Combination, including statements regarding the anticipated benefits of the Potential Business Combination, the anticipated timing of the Potential Business Combination, the products and services offered by LGM Enterprises and the markets in which it operates (including future market opportunities), LGM Enterprises’ projected future results, future financial condition and performance and expected financial impacts of the Potential Business Combination (including future revenue, pro forma enterprise value and cash balance), the satisfaction of closing conditions to the Potential Business Combination, the PIPE Offering and the level of redemptions of EGGF’s public stockholders, and LGM Enterprises’ expectations, intentions, strategies, assumptions or beliefs about future events, results of operations or performance or that do not solely relate to historical or current facts. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “scales,” “representative of,” “valuation,” “potential,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Presentation, including but not limited to: (i) the risk that the Potential Business Combination and the PIPE Offering may not be completed in a timely manner or at all, which may adversely affect the price of EGGF’s securities, (ii) the risk that the Potential Business Combination may not be completed by EGGF’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by EGGF, (iii) the failure to satisfy the conditions to the consummation of the Potential Business Combination, including the approval of the business combination agreement by the stockholders of EGGF, the satisfaction of the minimum trust account amount following any redemptions by EGGF’s public stockholders (if applicable), and the receipt of certain governmental and regulatory approvals, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement, (v) the effect of the announcement or pendency of the Potential Business Combination on LGM Enterprises’ business relationships, operating results, performance and business generally, (vi) risks that the Potential Business Combination disrupts current plans and operations of LGM Enterprises, (vii) the outcome of any legal proceedings that may be instituted against LGM Enterprises or EGGF related to the business combination agreement or the Potential Business Combination, (viii) the ability to maintain the listing of EGGF’s securities on a national securities exchange, (ix) changes in the combined capital structure of LGM Enterprises and EGGF following the Potential Business Combination, (x) changes in the competitive industries and markets in which LGM Enterprises operates or plans to operate, (xi) changes in laws and regulations affecting LGM Enterprises’ business, (xii) the ability to implement business plans, forecasts, and other expectations after the completion of the Potential Business Combination, and identify and realize additional opportunities, (xiii) risks related to the uncertainty of LGM Enterprises’ projected financial information, (xiv) risks related to LGM Enterprises’ potential inability to achieve or maintain profitability and generate cash, (xv) current and future conditions in the global economy, including as a result of the impact of the COVID-19 pandemic, and their impact on LGM Enterprises, its business and markets in which it operates, (xvi) the potential inability of LGM Enterprises to manage growth effectively, (xvii) LGM Enterprises’ customer concentration, (xviii) costs related to the Potential Business Combination and the failure to realize anticipated benefits of the Potential Business Combination or to realize estimated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions, and (xix) the ability to recruit, train and retain qualified personnel. The foregoing list of risk factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of EGGF’s prospectus filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 27, 2021, its Form 10-K filed on April 13, 2023, and other documents filed or to be filed with the SEC (including the proxy statement filed on November 13, 2023 in connection with the Potential Business Combination), as well as the “Investor Presentation Summary Risk Factors” attached to this Presentation. 2

F I NA NCI A L IN F OR M A T ION The financial and operating forecasts and projections contained in this Presentation represent certain estimates of LGM Enterprises as of the date thereof. LGM Enterprises’ independent public accountants have not examined, reviewed or compiled the forecasts or projections and, accordingly, do not express an opinion or other form of assurance with respect thereto. These projections should not be relied upon as being indicative of future results. Furthermore, none of LGM Enterprises or its management team can give any assurance that the forecasts or projections contained herein accurately represents LGM Enterprises’ future operations or financial condition. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of LGM Enterprises or that actual results will not differ materially from those presented in these materials. Some of the assumptions upon which the projections are based inevitably will not materialize and unanticipated events may occur that could affect results. Therefore, actual results achieved during the periods covered by the projections may vary and may vary materially from the projected results. Inclusion of the prospective financial information in this Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information are indicative of future results or will be achieved. The financial information and data contained this Presentation are unaudited and do not conform to Regulation S-X promulgated by the SEC. Accordingly, such information and data may not be included in, may be adjusted in, or may be presented differently in, any registration statement, prospectus, proxy statement or other report or document to be filed or furnished by EGGF, or any other report or document to be filed by the combined company following completion of the Potential Business Combination, with the SEC. Any “pro forma” financial data included in this Presentation has not been prepared in accordance with Article 11 of Regulation S-X of the SEC, is presented for informational purposes only and may differ materially from the Regulation S-X compliant pro forma financial statements of LGM Enterprises to be included any filings with the SEC. I NDUS T RY AN D M A RKE T D AT A This Presentation has been prepared by EGGF, LGM Enterprises and BTIG and includes market data and other statistical information from third-party industry publications and sources as well as from research reports prepared for other purposes. Although EGGF, LGM Enterprises and BTIG believe these third-party sources are reliable as of their respective dates, none of EGGF, LGM Enterprises, BTIG or any of their respective affiliates has independently verified the accuracy or completeness of this information and cannot assure you of the data’s accuracy or completeness. Some data are also based on LGM Enterprises good faith estimates, which are derived from both internal sources and the third-party sources described above. None of EGGF, LGM Enterprises, BTIG, their respective affiliates, or their respective directors, officers, employees, members, partners, stockholders or agents make any representation or warranty with respect to the accuracy of such information. A DDI T I O NA L IN F O R M A T IO N AN D W HE RE TO F IN D IT In connection with the Potential Business Combination, EGGF intends to file relevant materials with the SEC, including proxy statement on Schedule 14A, referred to as a proxy statement. A proxy statement will be sent to all EGGF stockholders. EGGF will also file other documents regarding the proposed transaction with the SEC. Before making any voting or investment decision, investors and security holders of EGGF are urged to read the registration statement, the proxy statement and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by EGGF through the website maintained by the SEC at www.sec.gov. The documents filed by EGGF with the SEC also may be obtained free of charge upon written request to EG Acquisition Corp. 375 Park Avenue, 24th Floor, New York, NY 10152. 3

explained I. EXECUTIVE SUMMARY 4

WORLD-CLASS AVIATION PARTNERSHIP Decades of aviation experience and entrepreneurial excellence ü Experienced aviation entrepreneur and operator ü Built Segrave Aviation and sold to Delta Private Jets Jim Segrave CEO ü President of Delta Private Jets 2010 – 2013 Gregg Hymowitz CEO & Director ü Founded flyExclusive in 2015 ü Seasoned jet pilot with 10k+ flight hours Gary Fegel Chairman Tommy Sowers Billy Barnard Rich Brennan Mike Guina President Interim CFO CDO COO 5

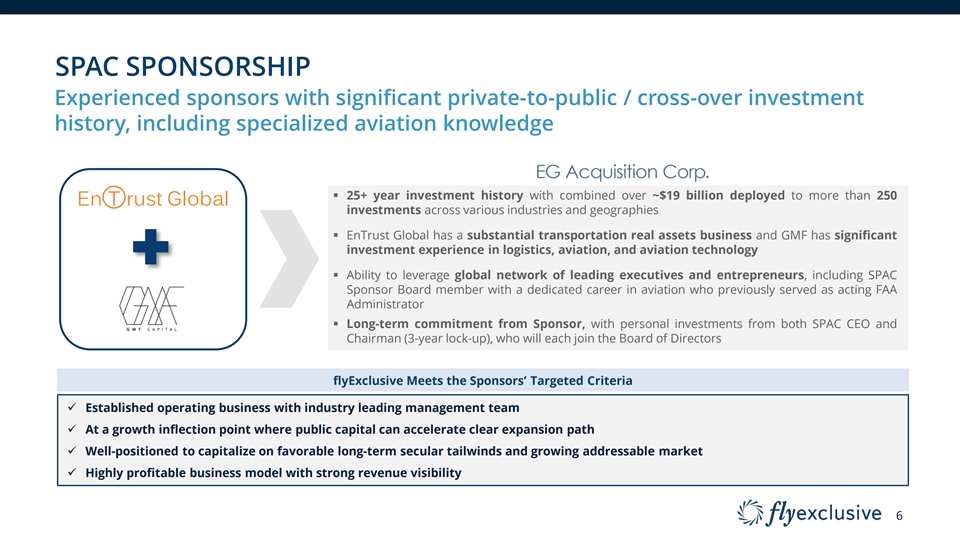

SPAC SPONSORSHIP Experienced sponsors with significant private-to-public / cross-over investment history, including specialized aviation knowledge § 25+ year investment history with combined over ~$19 billion deployed to more than 250 investments across various industries and geographies § EnTrust Global has a substantial transportation real assets business and GMF has significant investment experience in logistics, aviation, and aviation technology § Ability to leverage global network of leading executives and entrepreneurs, including SPAC Sponsor Board member with a dedicated career in aviation who previously served as acting FAA Administrator § Long-term commitment from Sponsor, with personal investments from both SPAC CEO and Chairman (3-year lock-up), who will each join the Board of Directors flyExclusive Meets the Sponsors’ Targeted Criteria ü Established operating business with industry leading management team ü At a growth inflection point where public capital can accelerate clear expansion path ü Well-positioned to capitalize on favorable long-term secular tailwinds and growing addressable market ü Highly profitable business model with strong revenue visibility 6

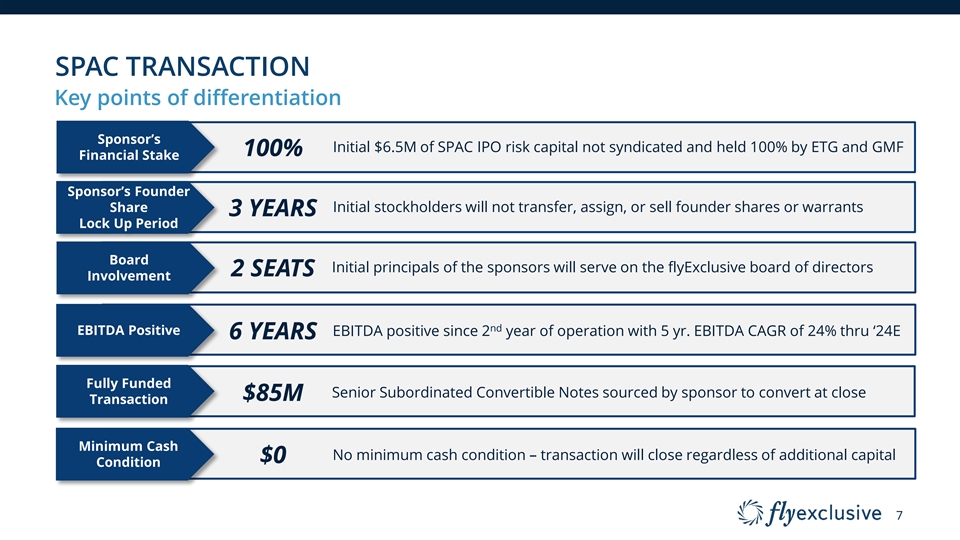

SPAC TRANSACTION Key points of differentiation Sponsor’s Initial $6.5M of SPAC IPO risk capital not syndicated and held 100% by ETG and GMF 100% Financial Stake Sponsor’s Founder Share Initial stockholders will not transfer, assign, or sell founder shares or warrants 3 YEARS Lock Up Period Board Initial principals of the sponsors will serve on the flyExclusive board of directors 2 SEATS Involvement nd EBITDA Positive EBITDA positive since 2 year of operation with 5 yr. EBITDA CAGR of 24% thru ‘24E 6 YEARS Fully Funded Senior Subordinated Convertible Notes sourced by sponsor to convert at close $85M Transaction Minimum Cash No minimum cash condition – transaction will close regardless of additional capital $0 Condition 7

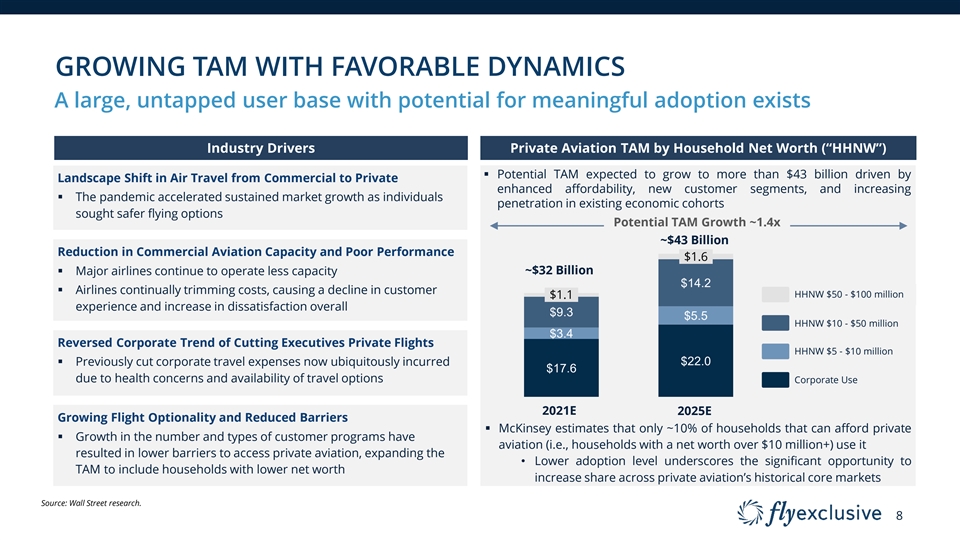

GROWING TAM WITH FAVORABLE DYNAMICS A large, untapped user base with potential for meaningful adoption exists Industry Drivers Private Aviation TAM by Household Net Worth (“HHNW”) § Potential TAM expected to grow to more than $43 billion driven by Landscape Shift in Air Travel from Commercial to Private enhanced affordability, new customer segments, and increasing § The pandemic accelerated sustained market growth as individuals penetration in existing economic cohorts sought safer flying options Potential TAM Growth ~1.4x ~$43 Billion Reduction in Commercial Aviation Capacity and Poor Performance $1.6 § Major airlines continue to operate less capacity ~$32 Billion $14.2 § Airlines continually trimming costs, causing a decline in customer HHNW $50 - $100 million $1.1 experience and increase in dissatisfaction overall $9.3 $5.5 HHNW $10 - $50 million $3.4 Reversed Corporate Trend of Cutting Executives Private Flights HHNW $5 - $10 million $22.0 § Previously cut corporate travel expenses now ubiquitously incurred $17.6 due to health concerns and availability of travel options Corporate Use 2021E 2025E Growing Flight Optionality and Reduced Barriers § McKinsey estimates that only ~10% of households that can afford private § Growth in the number and types of customer programs have aviation (i.e., households with a net worth over $10 million+) use it resulted in lower barriers to access private aviation, expanding the • Lower adoption level underscores the significant opportunity to TAM to include households with lower net worth increase share across private aviation’s historical core markets Source: Wall Street research. 8

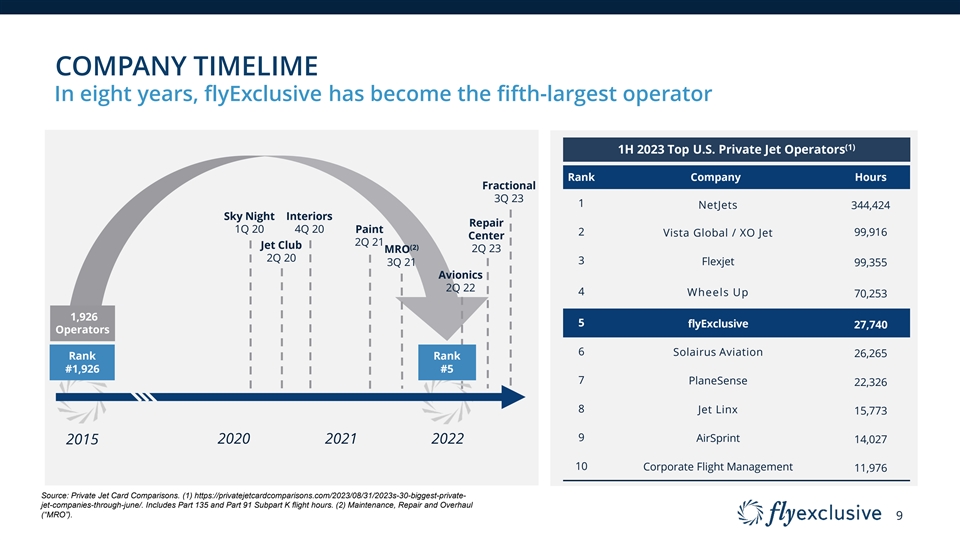

COMPANY TIMELIME In eight years, flyExclusive has become the fifth-largest operator (1) 1H 2023 Top U.S. Private Jet Operators Rank Company Hours Fractional 3Q 23 1 NetJets 344,424 Sky Night Interiors Repair 1Q 20 4Q 20 Paint 2 99,916 Vista Global / XO Jet Center 2Q 21 Jet Club (2) 2Q 23 MRO 2Q 20 3 Flexjet 3Q 21 99,355 Avionics 2Q 22 4 Wheels Up 70,253 1,926 5 flyExclusive 27,740 Operators 6 Solairus Aviation 26,265 Rank Rank #1,926 #5 7 PlaneSense 22,326 8 Jet Linx 15,773 9 AirSprint 2015 2020 2021 2022 14,027 10 Corporate Flight Management 11,976 Source: Private Jet Card Comparisons. (1) https://privatejetcardcomparisons.com/2023/08/31/2023s-30-biggest-private- jet-companies-through-june/. Includes Part 135 and Part 91 Subpart K flight hours. (2) Maintenance, Repair and Overhaul (“MRO”). 9

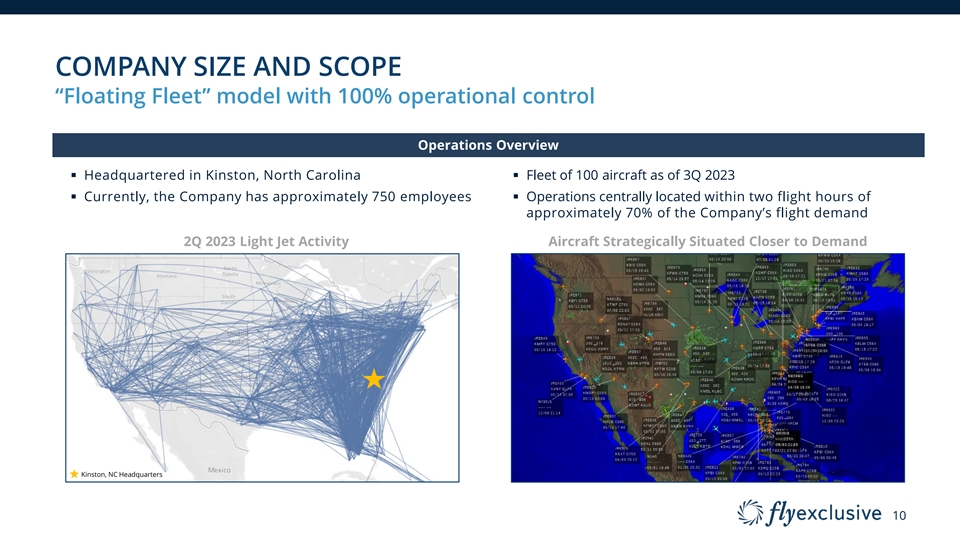

COMPANY SIZE AND SCOPE “Floating Fleet” model with 100% operational control Operations Overview § Headquartered in Kinston, North Carolina § Fleet of 100 aircraft as of 3Q 2023 § Currently, the Company has approximately 750 employees§ Operations centrally located within two flight hours of approximately 70% of the Company’s flight demand 2Q 2023 Light Jet Activity Aircraft Strategically Situated Closer to Demand Kinston, NC Headquarters 10

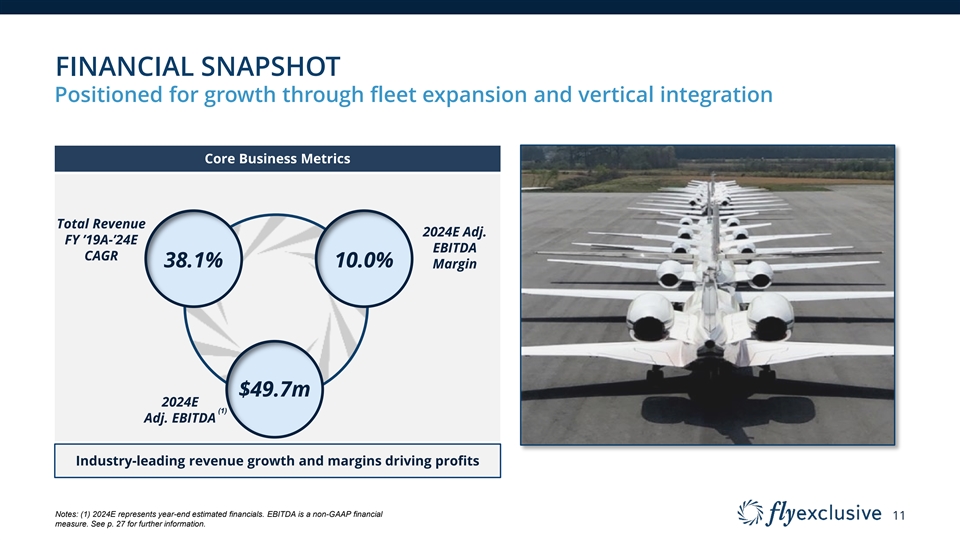

FINANCIAL SNAPSHOT Positioned for growth through fleet expansion and vertical integration Core Business Metrics Total Revenue 2024E Adj. FY ’19A-’24E EBITDA CAGR 38.1% 10.0% Margin $49.7m 2024E (1) Adj. EBITDA Industry-leading revenue growth and margins driving profits Notes: (1) 2024E represents year-end estimated financials. EBITDA is a non-GAAP financial 11 measure. See p. 27 for further information.

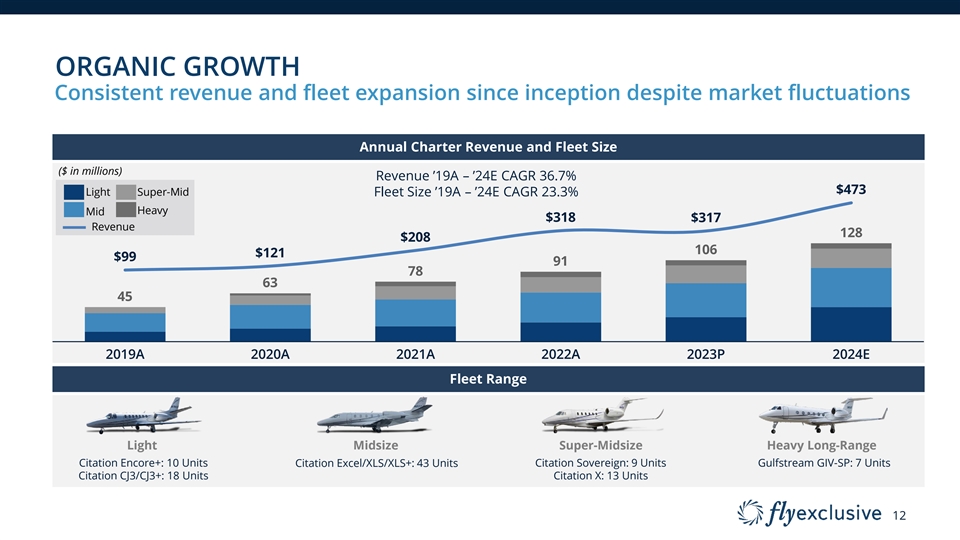

ORGANIC GROWTH Consistent revenue and fleet expansion since inception despite market fluctuations Annual Charter Revenue and Fleet Size ($ in millions) Revenue ’19A – ’24E CAGR 36.7% $473 Light Super-Mid Fleet Size ’19A – ’24E CAGR 23.3% Heavy Mid $318 $317 Revenue 128 $208 106 $121 $99 91 78 63 45 2019A 2020A 2021A 2022A 2023P 2024E Fleet Range Light Midsize Super-Midsize Heavy Long-Range Citation Encore+: 10 Units Citation Excel/XLS/XLS+: 43 Units Citation Sovereign: 9 Units Gulfstream GIV-SP: 7 Units Citation CJ3/CJ3+: 18 Units Citation X: 13 Units 12

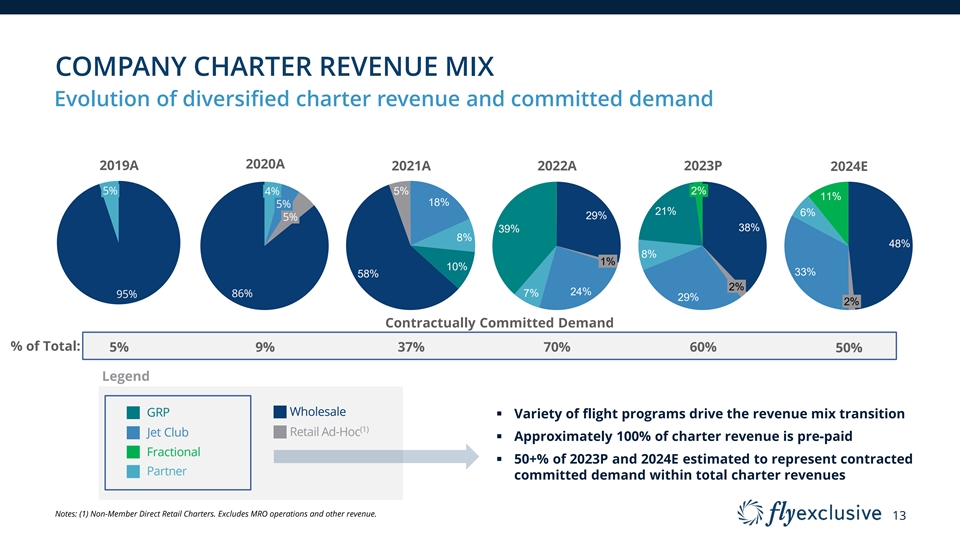

COMPANY CHARTER REVENUE MIX Evolution of diversified charter revenue and committed demand 2020A 2019A 2021A 2022A 2023P 2024E 5% 4% 5% 2% 11% 18% 5% 21% 6% 29% 5% 39% 38% 8% 48% 8% 1% 10% 33% 58% 2% 24% 95% 86% 7% 29% 2% Contractually Committed Demand % of Total: 5% 9% 37% 70% 60% 50% Legend Wholesale GRP § Variety of flight programs drive the revenue mix transition (1) Retail Ad-Hoc Jet Club § Approximately 100% of charter revenue is pre-paid Fractional § 50+% of 2023P and 2024E estimated to represent contracted Partner committed demand within total charter revenues Notes: (1) Non-Member Direct Retail Charters. Excludes MRO operations and other revenue. 13

INVESTMENT HIGHLIGHTS Proven Operator 1§ World-class private aviation executive who has founded, operated, and sold a previous business to Delta Air Lines Unique Business Model 2 § Diversified customer channels, vertically integrated operations, and optimized asset utilization Clear Growth Trajectory 3 § 80%+ retention among existing Jet Club members, as well as substantial contractually committed revenues Strong Market Backdrop 4§ Favorable long-term secular tailwinds in sector and ability to take additional share in a growing market Durable Competitive Advantages 5§ Strategic key initiatives and investments made to remove industry bottlenecks to growth and to maintain leading consistent customer experience 14

PROVEN OPERATOR I. EXECUTIVE SUMMARY 15

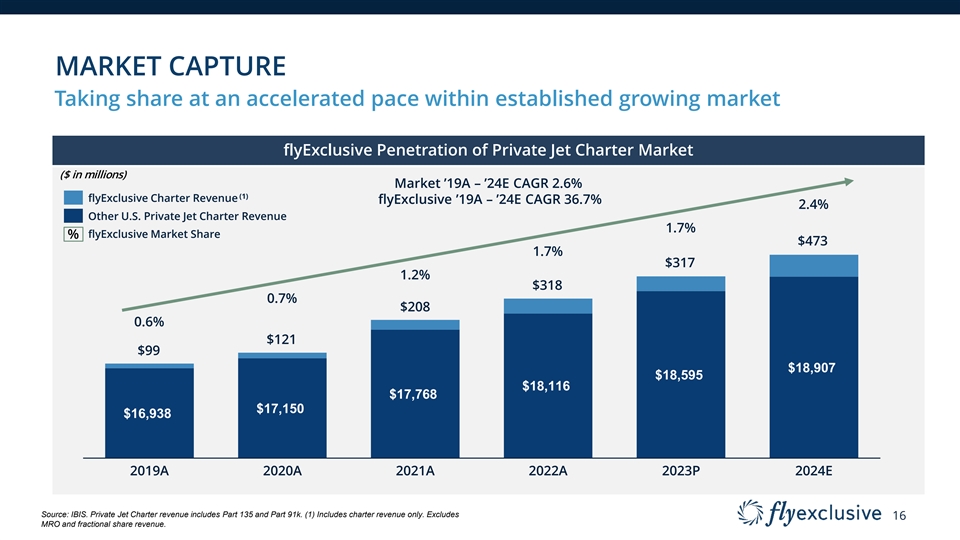

MARKET CAPTURE Taking share at an accelerated pace within established growing market flyExclusive Penetration of Private Jet Charter Market ($ in millions) Market ’19A – ’24E CAGR 2.6% (1) flyExclusive Charter Revenue flyExclusive ’19A – ’24E CAGR 36.7% 2.4% Other U.S. Private Jet Charter Revenue 1.7% % flyExclusive Market Share $473 1.7% $317 1.2% $318 0.7% $208 0.6% $121 $99 $18,907 $18,595 $18,116 $17,768 $17,150 $16,938 2019A 2020A 2021A 2022A 2023P 2024E Source: IBIS. Private Jet Charter revenue includes Part 135 and Part 91k. (1) Includes charter revenue only. Excludes 16 MRO and fractional share revenue.

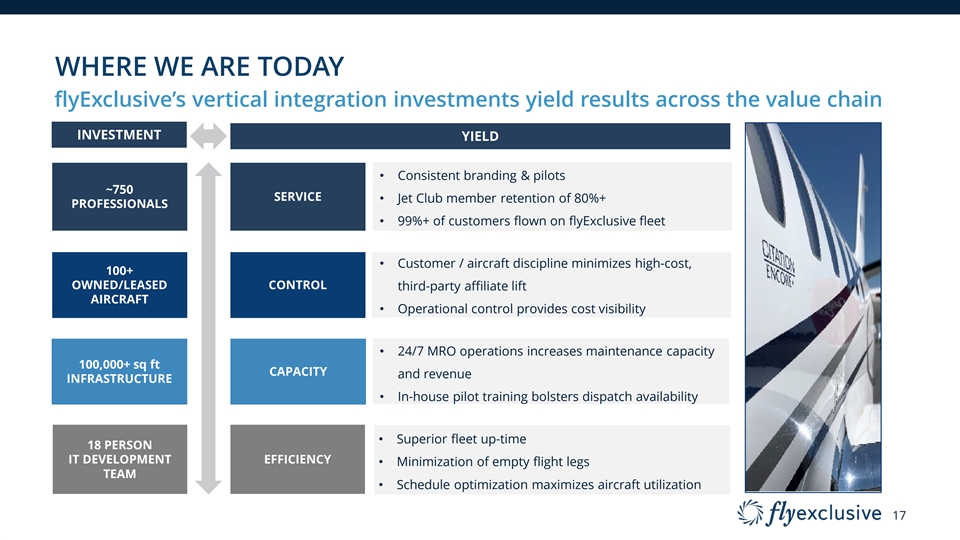

WHERE WE ARE TODAY flyExclusive’s vertical integration investments yield results across the value chain INVESTMENT YIELD • Consistent branding & pilots ~750 SERVICE • Jet Club member retention of 80%+ PROFESSIONALS • 99%+ of customers flown on flyExclusive fleet • Customer / aircraft discipline minimizes high-cost, 100+ OWNED/LEASED CONTROL third-party affiliate lift AIRCRAFT • Operational control provides cost visibility • 24/7 MRO operations increases maintenance capacity 100,000+ sq ft CAPACITY and revenue INFRASTRUCTURE • In-house pilot training bolsters dispatch availability • Superior fleet up-time 18 PERSON IT DEVELOPMENT EFFICIENCY • Minimization of empty flight legs TEAM • Schedule optimization maximizes aircraft utilization 17

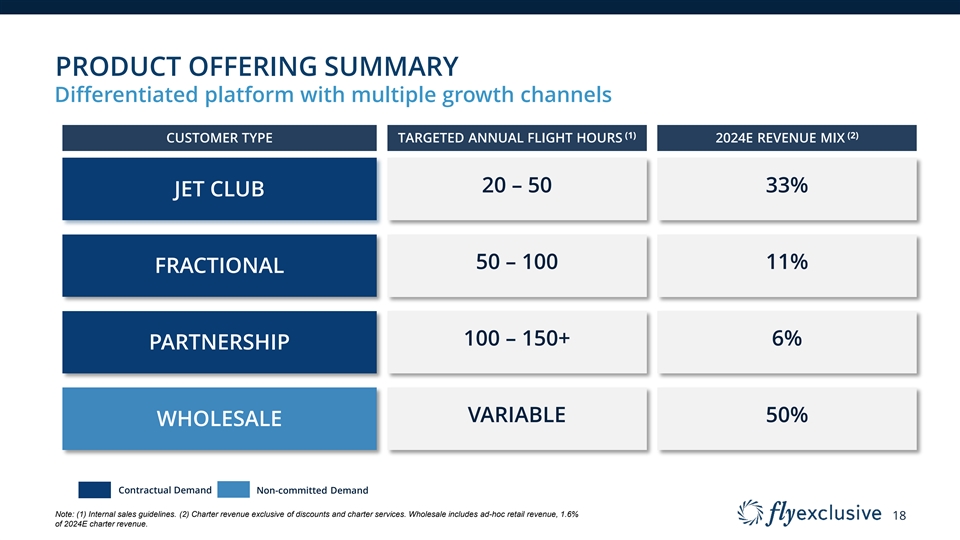

PRODUCT OFFERING SUMMARY Differentiated platform with multiple growth channels (1) (2) CUSTOMER TYPE TARGETED ANNUAL FLIGHT HOURS 2024E REVENUE MIX 20 – 50 33% JET CLUB 50 – 100 11% FRACTIONAL 100 – 150+ 6% PARTNERSHIP VARIABLE 50% WHOLESALE Contractual Demand Non-committed Demand Note: (1) Internal sales guidelines. (2) Charter revenue exclusive of discounts and charter services. Wholesale includes ad-hoc retail revenue, 1.6% 18 of 2024E charter revenue.

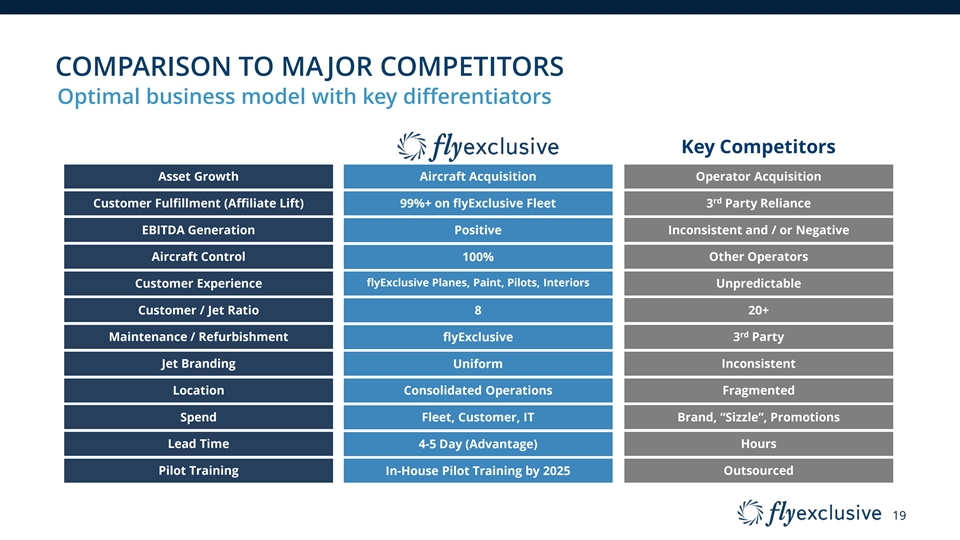

COMPARISON TO MA JOR COMPETITORS Optimal business model with key differentiators Key Competitors Asset Growth Aircraft Acquisition Operator Acquisition rd Customer Fulfillment (Affiliate Lift) 99%+ on flyExclusive Fleet 3 Party Reliance EBITDA Generation Positive Inconsistent and / or Negative Aircraft Control 100% Other Operators flyExclusive Planes, Paint, Pilots, Interiors Customer Experience Unpredictable Customer / Jet Ratio 8 20+ rd Maintenance / Refurbishment flyExclusive 3 Party Jet Branding Uniform Inconsistent Location Consolidated Operations Fragmented Spend Fleet, Customer, IT Brand, “Sizzle”, Promotions Lead Time 4-5 Day (Advantage) Hours Pilot Training In-House Pilot Training by 2025 Outsourced 19

COMPETITIVE ENVIRONMENT AND DIFFERENTIATORS I. EXECUTIVE SUMMARY 20

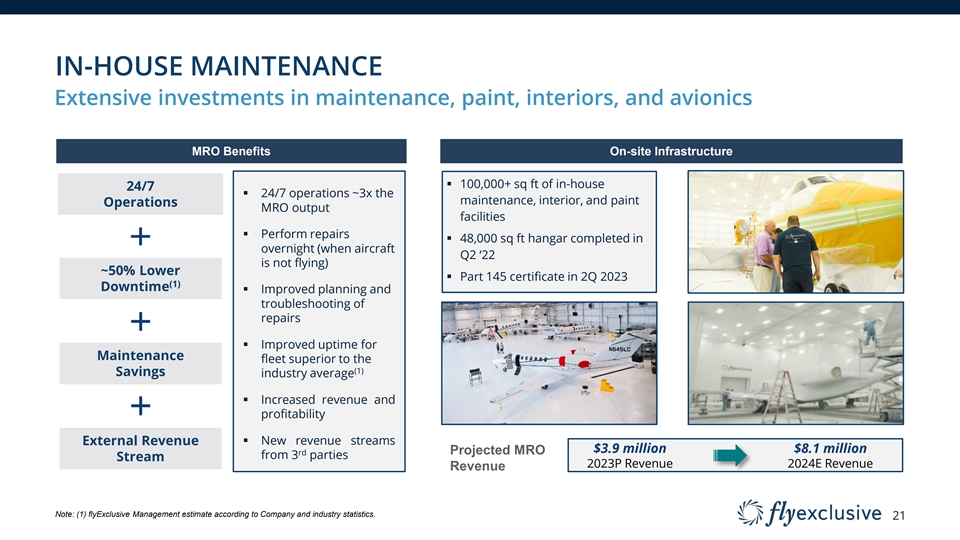

IN-HOUSE MAINTENANCE Extensive investments in maintenance, paint, interiors, and avionics MRO Benefits On-site Infrastructure § 100,000+ sq ft of in-house 24/7 § 24/7 operations ~3x the maintenance, interior, and paint Operations MRO output facilities § Perform repairs § 48,000 sq ft hangar completed in overnight (when aircraft Q2 ‘22 is not flying) ~50% Lower § Part 145 certificate in 2Q 2023 (1) Downtime § Improved planning and troubleshooting of repairs § Improved uptime for Maintenance fleet superior to the (1) Savings industry average § Increased revenue and profitability External Revenue § New revenue streams $3.9 million $8.1 million Projected MRO rd from 3 parties Stream 2023P Revenue 2024E Revenue Revenue Note: (1) flyExclusive Management estimate according to Company and industry statistics. 21

PILOT TRAINING “Build versus buy” strategy to address the pilot training industry challenge PILOT TRAINING CENTER § On-campus pilot training facilities will remove one of the ON-CAMPUS greatest bottlenecks to growth within the aviation industry FACILITIES § Training in Kinston builds company culture within a remote workforce § Faster on-boarding by reducing training wait times § Lower costs through flyExclusive simulator facility ONBOARDING § Simulator screening checks pre-hire § Additional training resources available to test aptitude, not just promotion based on seniority TRAINING § Deeper and more frequent training increases efficiency § Expedited crew availability increases dispatch availability, or uptime UPTIME § Increased flight hours contribute to greater profitability 22

WHY FLYEXCLUSIVE WINS Focus on executing growth with operational control § Service excellence and consistency drive everything Vertical § Reliable and repeatable service execution is aligned with cost and return management Integration § Value is created simultaneously for customers, shareholders & flyExclusive with a single strategy § Consolidated operations optimize costs and synergies Maintenance § In-house maintenance and fleet control drive superior service and operating visibility and Staffing § Pilot sourcing and training are a key competitive differentiators § Technology enables and supplements our strategy § AI / ML dynamic pricing and apps developed in-house Technology § Technology focused primarily on improving operational efficiency and customer experiences § Deliberate, capital-light fleet growth matched with committed demand via Fractional and Partnership programs Asset Growth § Purposeful focus on select aircraft types drives scale and synergy benefits 23

FINANCIAL OVERVIEW I. EXECUTIVE SUMMARY 24

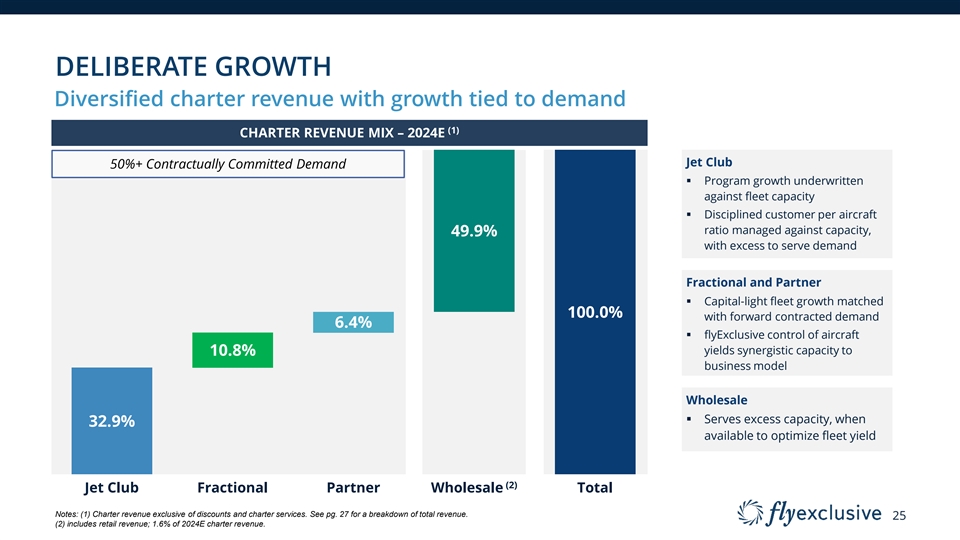

DELIBERATE GROWTH Diversified charter revenue with growth tied to demand (1) CHARTER REVENUE MIX – 2024E Jet Club 50%+ Contractually Committed Demand § Program growth underwritten against fleet capacity § Disciplined customer per aircraft ratio managed against capacity, 49.9% with excess to serve demand Fractional and Partner § Capital-light fleet growth matched 100.0% with forward contracted demand 6.4% § flyExclusive control of aircraft yields synergistic capacity to 10.8% business model Wholesale § Serves excess capacity, when 32.9% available to optimize fleet yield (2) Jet Club Fractional Partner Wholesale Total Notes: (1) Charter revenue exclusive of discounts and charter services. See pg. 27 for a breakdown of total revenue. 25 (2) includes retail revenue; 1.6% of 2024E charter revenue.

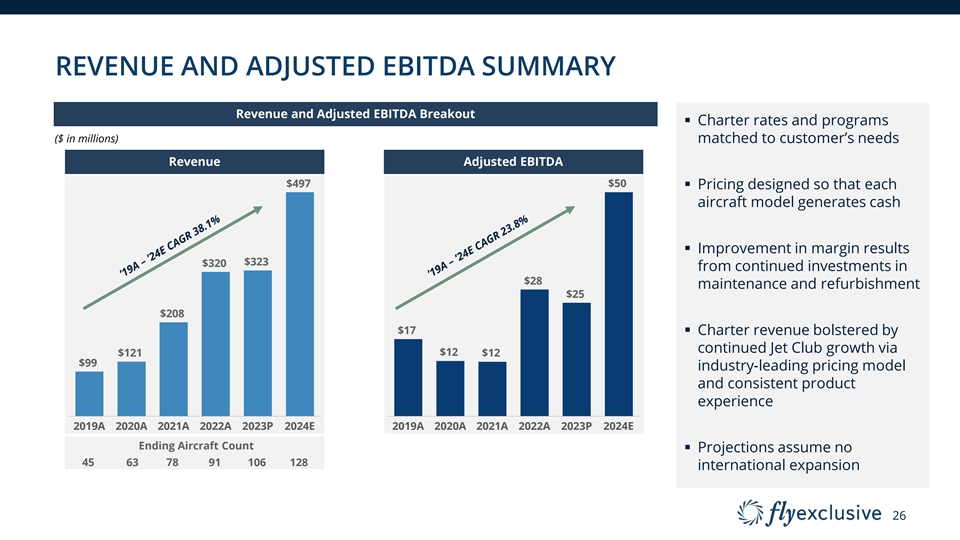

REVENUE AND ADJUSTED EBITDA SUMMARY Revenue and Adjusted EBITDA Breakout § Charter rates and programs ($ in millions) matched to customer’s needs Revenue Adjusted EBITDA $497 $50 § Pricing designed so that each aircraft model generates cash § Improvement in margin results $323 $320 from continued investments in $28 maintenance and refurbishment $25 $208 $17 § Charter revenue bolstered by continued Jet Club growth via $12 $121 $12 $99 industry-leading pricing model and consistent product experience 2019A 2020A 2021A 2022A 2023P 2024E 2019A 2020A 2021A 2022A 2023P 2024E Ending Aircraft Count § Projections assume no 45 63 78 91 106 128 international expansion 26

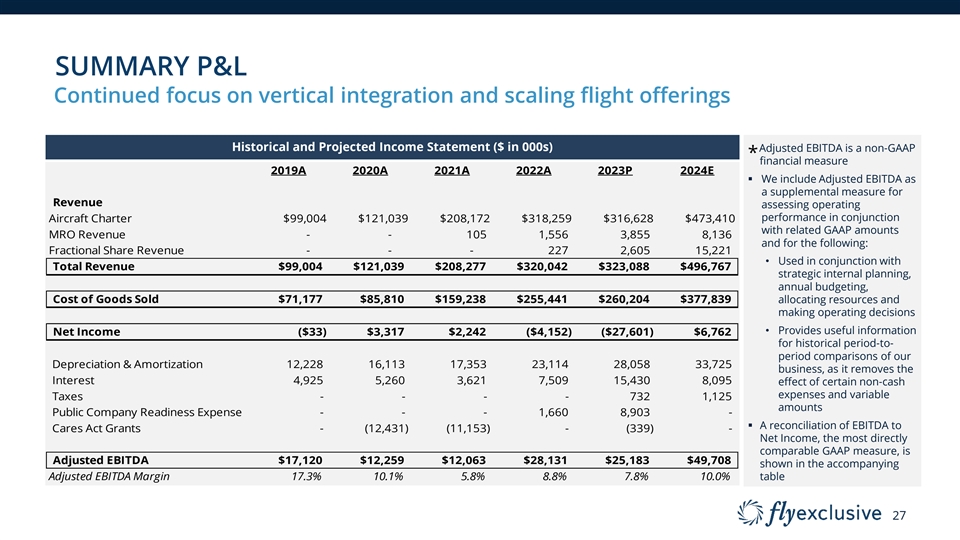

SUMMARY P&L Continued focus on vertical integration and scaling flight offerings Historical and Projected Income Statement ($ in 000s) Adjusted EBITDA is a non-GAAP * financial measure 2019A 2020A 2021A 2022A 2023P 2024E § We include Adjusted EBITDA as a supplemental measure for Revenue assessing operating performance in conjunction Aircraft Charter $99,004 $121,039 $208,172 $318,259 $316,628 $473,410 with related GAAP amounts MRO Revenue - - 105 1,556 3,855 8,136 and for the following: Fractional Share Revenue - - - 227 2,605 15,221 • Used in conjunction with Total Revenue $99,004 $121,039 $208,277 $320,042 $323,088 $496,767 strategic internal planning, annual budgeting, Cost of Goods Sold $71,177 $85,810 $159,238 $255,441 $260,204 $377,839 allocating resources and making operating decisions • Provides useful information Net Income ($33) $3,317 $2,242 ( $4,152) ($27,601) $6,762 for historical period-to- period comparisons of our Depreciation & Amortization 12,228 16,113 17,353 23,114 28,058 33,725 business, as it removes the Interest 4,925 5,260 3,621 7,509 15,430 8,095 effect of certain non-cash expenses and variable Taxes - - - - 732 1,125 amounts Public Company Readiness Expense - - - 1,660 8,903 - § A reconciliation of EBITDA to Cares Act Grants - (12,431) ( 11,153) - ( 339) - Net Income, the most directly comparable GAAP measure, is Adjusted EBITDA $17, 120 $12, 259 $12, 063 $28,131 $25, 183 $49, 708 shown in the accompanying Adjusted EBITDA Margin 17.3% 10.1% 5.8% 8.8% 7.8% 10.0% table 27