Filed by EG Acquisition Corp.

Pursuant to Rule 14a-12 under

the Securities Exchange Act of 1934

Subject Company: EG Acquisition Corp.

Commission File No.: 001-40444

Information regarding LGM Enterprises, LLC (dba flyExclusive) (“LGM”) was published in a May 23, 2023 Bloomberg article (the “Article”). The Article is provided below. The text of the Article includes the following statement: “Kinston, North Carolina-based flyExclusive is expected to have operating cash flow of about $64 million this year and sees that doubling to $130 million next year, according to a May proxy filing.” The foregoing statement lacks certain context and contains certain inaccuracies. In particular, the financial projections referenced (such projections, the “LGM Projections”) were sourced from financial projections provided to the Board of Directors (the “Board”) of EG Acquisition Corp. (“EG”) in October 2022 in order to assist the Board in its determination of whether or not to approve the transactions contemplated by that certain Equity Purchase Agreement, dated October 17, 2022, by and between EG, LGM and certain other parties thereto. The LGM Projections were prepared prior to LGM undergoing a PCAOB audit and investors are encouraged to review the financial statements of LGM included in the preliminary proxy statement filed on May 5, 2023, including the financial information in the section of the preliminary proxy statement entitled “Unaudited Pro Forma Condensed Combined Financial Information”. Further, while the text of the Article refers to projected “operating cash flow” of $64 million in 2023 and $130 million in 2024, such numbers were presented in the LGM Projections as “EBITDA” projections, not “operating cash flow” projections.

Private Jets, Hot off Pandemic Surge, Face New Hurdles and Fewer Customers

| • | Private flights in US dropped 4.5% in 1Q from year earlier |

| • | FlyExclusive plans SPAC public listing, valued at $900 million |

By Thomas Black

May 23, 2023 at 8:00 AM EDT

Jim Segrave has provided private jet services to wealthy clients for decades. He chartered flights through the financial woes of 2008 and through hurricanes that slammed his home state of North Carolina, forcing him to salvage equipment from his flooded office building using a canoe.

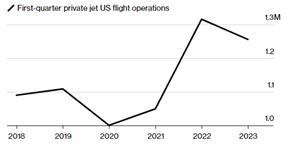

But Segrave’s biggest test yet may come this summer as he pushes forward with a public listing of flyExclusive Inc., which operates more than 90 private jets, through a special purpose acquisition company that values his business at $900 million. Private flights in the US have declined from their pandemic highs, with takeoffs and landings dropping 4.5% in the first quarter from a year earlier. The drop accelerated to 9.3% in April compared with an 8.6% decrease in March.

Besides the demand decline, the industry is also grappling with inflation, especially around a lack of maintenance technicians and pilots. The aircraft market remains tight as a lingering supply-chain shortage impedes planemakers from ramping up production faster. Over the long term, the industry is under growing pressure to mitigate or offset its greenhouse gas emissions.

Flexjet, the second-largest US operator of private jets behind NetJets Inc., shelved its SPAC listing last month, paying $30 million to call off the deal. Wheels Up Experience Inc., which went public in 2021 via SPAC, has struggled to turn a profit even as sales have grown.

The Descent

US business jet takeoffs and landings drop in first quarter from 2022 record

Source: Federal Aviation Administration data

- 2 -